Indeed the rebound yesterday was not the reversal everyone hoped for. From my limited charting experience, i will dislike if the reversal has been sharp and swift. It will then remind me of how world market rebounded in the tech bubble and then collapse spectacularly. Trading along this range is actually healthy to the longer term. Weak holders will be shaken out and then there will be no exuberence in the stock market. When there is no exuberence, there will be no crash coming. From the many charts i saw with sharp price decline and light volume, the best case scenario would be to slowly climb back up on the right side to balance the selling and the buying. Any frantic chase up of the stock will result in breakout failure.

So far light volume decline has been a good trading signal to me. I just have to remain confident and not sell unneccessary. The fact is that some of this low volume decline has reversed last 2 days. Mine better start soon too.

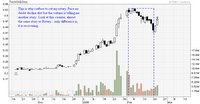

People's Food

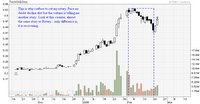

Tech oil gas

STX PO: Cup and handle formation

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.