Once again another big move eludes me. I'm grown so used to it by now. Somehow i have adjusted my trading plan/system to accomodate this weakness of mine. The consolation is, profit though small is better than having none at all. In the future, i will be taking quick profits! I have seen at least 15% of total trading account paper profits gone up in smoke after i overstayed in a stock thinking the light decline is fine. Infact i beginning to doubt this method that i went back to my books over the weekend. Yeah, i did miss out some crucial factors contributing a valid formation. I think i better make it my bed time story book just to make sure i remember them all the time.

Market action wise, there is really nothing to shout about. I thought it was a natural rebound from oversold counters. Most of the charts i gone through saw many sharp declines without volume. Although this is primarily a good sign, but the angle of decline makes me uncomfortable. There were of course some stunner like MediaRing...87 million shares traded...something is cooking other than the Google collaboration. I'm way past my pivot buy point for it and thus not chasing it anymore. Good luck to all my visitors who are enjoying the ride up! cheers! Let's hope this week is a much better one than the last!

Tomorrow I'll be attending a options trading talk! Hence I will not be chatting at the shoutbox hor. But i will still be in touch with the market via GPRS keke so when market rallies, i will be cheering too! :D

Darco Water: Very good and clear chart formation building. Current actions seems to be hammering out a handle area which functions as a shakeout area for weakholders.

Rotary: Suport line broken. The rebound in price must test and break 0.550 otherwise we risk a head and shoulder reversal pattern. I'm pleased with the closing at 0.510 with volume. With indicators in oversold, we have a fighting chance to reverse nicely.

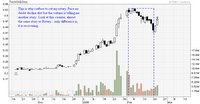

MediaRing: Bought at 0.260 and sold at 0.295 was suppose to be a good trade until it closes 0.345 today. There is no way i can anticipate a massive rally like today. I followed the book and decided on this profit level after it failed to clear resistance on Friday. With a bad and directionless market on going, i thought taking profit was the wisest thing to do. Furthermore, all my other holdings are declining without heavy volume selling. So why should i risk it when i have clear profits? Many a times I saw my good paper profits diminished with a declining market. Henceforth i told myself to set a target and just take profit. I must be realistic. In a year, there are more chances to see paper profits diminish rather than encountering a big move up north. I shall wait for the next base to form before jumping in.

DataCraft: The rebound came and it was a relieve. Next up, should be a move up to test the upper channel resistance. I had hung on to the decline refusing to sell because of the low volume. My thoughts were, although the price has decline steadily but the selling volume is very low as compared to it's move up. Most likely it was hurt by the bad sentiment and directionless market. Smart money sell at the top and they don't sell on the way down like this in liht volume or so I thought. Next, we should see investors coming in to support DataCraft at this level and then a retest of the high. IT is important that the next high must be higher than 1.14 or we risk a head and shoulder reversal pattern.

GrowMoney QuickPickIt's back! : ) The following stocks had declined with volume much lower than average. They can die slowly but also can recover swiftly since volume is rather low during the selling.

Do not Contra! Pearl Energy

BeautyChina

Brilliant

MemoryD

DataCraft

Cougar

Darco

MFS

Pac cent

Sembkim

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.