Stats Chip

Welcome to my trading journal! A place where I share my Psychology, Money Management & Trading system on trading shares in the Singapore Stock Market. Fellow shares enthusiasts are welcomed to share thoughts too. I hope my posts will be educational to you in your quest to growmoney. I can be reached at eehwa.ng@gmail.com outside of the blog.

Thursday, July 28, 2005

Bulls take charge!

Wednesday, July 27, 2005

Market roared alive! Focus on Rotary

Tuesday, July 26, 2005

East Meets West & The Satay Stick Analysis

In his book, Steve has said to combined eastern candlestick analysis with western indicators for a more complete analysis. As for me, I devised my own "Satay Stick Analysis". hahaha :D I used Candlesticks + Stochastics + MacD Histogram(weekly chart) to pin point buying signal for short term trading.

Monday, July 25, 2005

Muted market

People's Food: It was mentioned in the forum alot today. T.A wise, a buy with tight stop loss. I would advise caution with this one as China had news of farmers dying with a mysterious virus after slaughtering pigs. If it is confirmed, then this fella might head south.

Jurong Tech: The recent heavy selldown has eroded away my profit in this counter. It sets me pondering. How should I avoid this? I refered to my trading book and remembered this "As soon as the price move away from daily average, the rule of thumb is to protect 50% of paper profit"..... Another lesson learnt. I'm lucky i can learn this from paper profit. If I had used cash. The lesson will be learnt with a price.

Raffles Education: Another trend reversed in Decipher Gems list. Dumped out of my list.

Rotary: Trading chance! Weekly trend seems to head up and this is inline with the gas and oil play reported after a rebound in oil price. Click the chart to see cut loss and buy.

SMT: A turn in the weekly trend was spotted. Trend reversed. Vested at 0.715, now cut at 0.740. A 0.025 profit.

From all my paper trading in a bid to test my trading system, I have received harsh comments that paper trading is useless as emotions are not involved. Emotions normally hinder our thinking process. I agree with that. However, it must be noted that paper trading gives you a chance to fine tune your trading system or method against good or bad market condition. It sort of get you ready to do cash trading. Why do we have fire drill evacuation? It is to allow you to know what to do when you hear the fire alarm. Now think about trading, when a sell or buy signal is generated, from all the practises via paper trading you will know what to do.

Things i learnt so far:

1) 50% profit protection

2) Buy only when the Weekly Histogram is below Zero line. In Decipher Gems, only ST-Eng is picked from below zero. The rest were medium risk decision where the histogram was above zero. Rational being, when it is under zero, it has more upside. If you have doubts, just look at the above charts posted, you will realised that right from the bottom of these reversals, the profit is much higher! Check out my blog daily. Whenever I find such GEMS, I will share with you! Although sometimes I do feel left out in rallies, but I tell myself not to be bothered as chasing rallies can result in very painful lessons.

Tomorrow Suntec Reits Results, watch out for it!

People, I had added a Fundamental link on the left. Look out for it. It contains my research on investing stocks based on Fundamental Reasons. Decipher not only knows T.A, I am learning F.A too. I think the our CPF needs to be invested in good fundamental stocks rather than just earning the miserable interest by CPF. hehe

Sunday, July 24, 2005

STI at dizzying height; Sesdaq catching up!

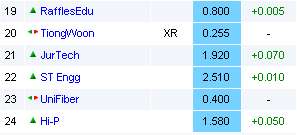

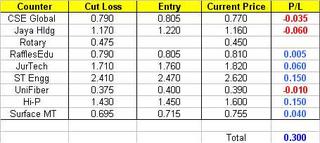

Decipher Gems: suffer a setback when Jaya Holdings and CSE faced some serious sell down. However overall it's still a +0.30 gain. Jaya Holdings, Rotary and CSE will be taken out of the list as their weekly trend have turned down.

UniFiber:

I sold unifiber on Friday. It's a really stupid decision on my part because I did not follow my rules. I decided to cut loss after it dipped to 0.385 on intraday trading but it closed at 0.390. On the chart it's not a sell signal. The previous day closing was down 1 cent and it affected me a great deal. I have commited this mistake hell lot of times. If unifiber cheong this coming week, i'm going to bang balls!

Junma: Due to the revaluation of the Yuan, this china play could be the next to move up. It's supply rubber for car tires. If it can import materials to make tire cheaper, it's margin will improve. I'm not sure how true and am not very familiar with it's business. But it pays to pay attention to this. Chartwise it has been lying low for sometime now. Just keep it in the watch list and not a Decipher Gem due to it's lack of market interest. Just found out, Junma's business is in china only. Yuan evaluation can only be helpful if they import raw materials. So they can have a more comfortable margin potentially if they import their materials from overseas.

Full Apex as requested.

As for my comments on HGM,

What is the business risk of HGM? Demand of Steel and Steel prices. Falling steel price is thought to be due to supply over demand. Steel production will slow down to curb the current situation, thus causing the price to stablise. After that steel price will go up! Because the demand is still strong. Construction is happening everywhere. Marine sector is still flourishing. They need steel plates for ship repair. New Oil Rig orders fills the news every week. All these are build on steel and not plastic or rubber. So i conclude Demand for steel is still strong while price of steel will stay stable. HGM's earnings will continue to stay strong as long as demand of steel is there. Wait for me dudes, i'm going to study the last steel cycle and see the similarities and differences. After that, i will share again.

As for the share price, it lacks market interest. I suppose HGM is seen as a small stockist out there.

By the way, i'm IT analyst hor, not economy analyst! hehehe so any expert please comment. Thanks!

My comments for Suntec Reits:

I suppose Suntec Reits is poised to take full advantage for it's office rental business when office space starts to get expensive in Singapore. It was reported that office space in Singapore is still considered at it's low. So chances of upside is unlimited. With it's close proximity to the 2009 Casino and the MRT to be built right next to it, this fella should be worthwhile to collect. Recent share price volatility should not be of much concerned if you plan to hold it long term say 5 to 10 yrs. Let's not forget about the properties it acquired recently. Once office rental hots up, Suntec will be mentioned time and again.

I hope market gurus out there can comment and teach me a thing or two if i am wrong in my analysis. Thanks in advance!

Friday, July 22, 2005

Thursday, July 21, 2005

Descendents of Dragon has unpegged

If i am an importer when my currency is higher, i will import cheaper

If i am an exporter when my currency is higher, my customer will pay more thus i have to squeeze my margin to compete.

So, do know what China counters you are buying. Decide whether they export or import. Tomorrow will be an interesting show.

HGM surprised me and my fellow trader friends with it's white candle today. The volume is quite heavy at 4 million. Let's revisit the double bottom chart i posted last week.

http://growmoney.blogspot.com/2005/07/hgm-double-bottom-formed-or-am-i.html

From T.A point of view, some form of reversal is in the making, given the poor sentiment towards high steel prices, never thought it actually came true. I hope this reversal can test the all time high for the third time!

As for the general market, mixed day of trading yet again. Profit taking sets in for property counters after their amazing run up for the past 2 days.

Much to my dismay, Unifiber closed down at 0.390 today! Very very disappointed. I was anticipating to collect profits, never thought that i would need to study the cut loss level today. What to do, such is luck. Why didn't i buy Jurong Tech? Hi-pi or St-Eng? Of so many gems, i had to choose unifiber? Something that refuse to move? Give me a break! Confidence sometimes need a bit of luck to make one feel better!

3 gems looks set to be delisted from my Decipher Gems list. Check out the charts. No new gem spotted by my trading system today.

Why is a bullish market mixed?

With STI reaching 3 yr high, overbought sentiment sets in. Retracement ought to come in sooner or later. Those buyers who chased high price last week are suffering now. From what I see, only property and blue chips are moving. Penny stocks are quite quiet. Lesson revisited! Never chase high price.

Decipher Gems suffered with Rotary and Jaya holdings falling the most. This sets up a question in me about profit taking. Although the counters weekly trend is still up, do i wait till most of my profits turn into air and exit only at the turn of the weekly trend? Maybe I should protect 50% of paper profit? Which means to say, when a counter retrace back 50% of my paper profits, i sell and keep my money. Worth a thought.

Unifiber still elusive...it's been 6 trading sessions of consolidating. I thought yesterday's heavy buy up was a sign to come. However, it never did. Patience...it's so demanding emotionally. I think cases like unifiber can replace fishing as an activity man, you keep waiting for it to break upwards just like you are to wait for a fish to get caught in your hook! hahaha! Patience.

No new Gem was found in my system yesterday.

Wednesday, July 20, 2005

Property Boom!

Just like terrorist attacks which can drag the stock market down. This kind of good news is also beyond T.A or F.A. But I wonder for the person who typed the statement for our minister to read out, did he or she secretly buy? :P

The market was pretty mixed although the STI rallys to new high again. Winners beat gainers only just. And the STI high is mainly contributed by property stocks. Profit taking was in place in other counters that had made some gains in recent sessions. I suspect the bulls are resting...bears were powerless amidst good news from corporate earnings and market. Many had forgotten about high oil price. I bet that for the next down move, analyst will attribute it to profit taking and high oil price. They look for excuses for the movement after it happened. But it's their job, to analyse why the market moved. hehe That's why they are called analyst and not prophets.

Decipher Gems took part in the rally yesterday and most of them continue their upwards move. I'm still stuck in Unifiber. It refused to move upwards. The weekly trend is still up, and yesterday's drop has caused the daily chart indicator to fall below zero line. It's a sign to up my stakes as it points to a move towards north. Let's see if it can happen. Cheong arh!!!!

Today's spotlight no doubt will be in property. Will there be more upside? Even Casino announcement didn't have so much impact than the news yesterday.

Monday, July 18, 2005

Bulls losing steam

Vol 720.6 M Val 760.0 M

Rise 206 Fall 230

June's non oil export fall short of analyst's estimates and affected trading sentiment. Many of the counters that had moved up sharply had taken a U-turn. This is the reason why I shouldn't chase after high price. Retracements are bound to happen as it's human to take profit when it soar high enough. Question is, will there be continuing buying? Oil, Gas and energy plays are reported to have more upside.

Decipher Gems, the more i see unifiber, the more impatient i got. It's been consolidating for a long time now. On the charts, an Ascending Triangle could form. This will result in an upside breakout of price. As for CSE, it has touched my cut loss at 0.790. But it's thin volume today caused no alarm. Only if it goes below my cut loss then I will consider it as turned sour. It's weekly trend is still upwards. I'm waiting for Jurong Tech and ST-Eng to retrace further, their weekly uptrend are intact, however i need to see more retracement before the risk/reward gets good enough for a punt at the babies (warrents)! The rest of the gems are still having weekly uptrend.

No new gem found in my trading system today. This could be testiment that my system would not be conned by a fake bull! :D

A watch out for tomorrow:

Minister of National Development Mah Bow Tan will announce policy changes affecting the property market at 3.00 p.m. Singapore time (0700 GMT) Tuesday.

Sunday, July 17, 2005

Worries unfounded?

Vol 979.8M ; Val 887.0M

Rise 202 ; Fall 272

Our market closed mixed on Friday amidst profit taking. It is the second day in a row where gainers and losers are trading closely. Looking back, the market has moved up alot to where it is today and infact has touched a new high in 3 yrs last week with heavy volume. Don't be surprised by any retracement. Oil price hit highs again. But our market continues to ignore it. The target of US$80 per barrel has factored in the price? My mistake was to predict what will happen, now i simply follow the trend.

Flashback! Allow me to "hao lian" (proud) abit.....I said to stay clear people's food in my old post...look! it came true! keke

http://photos1.blogger.com/img/288/6339/640/ppfood1.jpg

Decipher Gems! Tiong Woon has been removed from my list because of illiquidity. Unifiber continues to be a mystery to me. Last few sessions suggesting consolidation in progress. This is my only cash trade among my Gems...doing well in this trade will certainly boost my confidence. Anonymous has correctly said that one of the reasons my Gems is performing well due to current bullish market sentiment. I agree. Hence I spent sometime scrolling back to June where I first blog seriously. I had no gems back then althought market is moving already. I even started a chart request on the left to kill boredom. I think my trading system filter counters that are in uptrends only. If you click on my picture, you will be able to read about my trading system. So if it's a bearish market, i'm sure my trading system will not pick up any "lobangs" (opportunities). However we can always open a SBL account and go short instead! hehe

I'm trying to get a site search to work on my blog so that we can search for old postings on counter's charts that has been posted. You can scroll all the way down to try.

Friday, July 15, 2005

CPF Investment Choice

SPH

ST-Eng

NOL

SGX

SIA

Singpost

SPC

Not in order of preference! :lol:

Thursday, July 14, 2005

Bulls Beat Bears But Only Just!

Vol 1036.8 M; Val 993.9 M

Rise 255; Fall 227

The volume is still heavy and the STI close up mainly because of the surge in Creative. Apple had released a strong set of results for Q3 and it's due mainly to strong sales in Ipod. I am really excited to see how Creative shares will perform tomorrow. On the international scene, oil price continues to slide and our trade partner USA's major indices are roaring accross the ocean. The rally ain't done yet...it's not done yet! :D

And once again my gems performed! This time it's is amid a rather mixed market. Hence I'm growing confident that my trading system is working well for me. However my first cash trade on Unifiber has yet to show result. I'm getting emotional here. The fear of it sliding southwards on the chart scares me. I have lost far too many times. So any trade that doesn't works well is scary to me. But as the saying goes, have a plan, trade a plan. I just have to trust my system. Many people has asked me to guess the direction of stocks. "Will it goes up or down?" I think from all my research in the past, the best answer I can offer is, "know how much you are going to lose in this trade". We can't guess 100% where is the price heading. But we can control how much we will lose. Money to trader is oxygen to divers, i will always remember that.

A fellow forummer brought up a very good reminder that National Day is coming. It's almost a tradition to have a rally before the National Day. We termed it the National Day Rally. I refered to my old blog (You can find it under links on the left) and found out that there was really a rally amidst high oil price! Just like now! Then, I was cautious and stayed out of the market. Now I should know better.

I had invited lots of traders from other forum here today. Welcome guys! I hope you enjoyed my article and hopefuly my Gems. :P Do share your experience or comments. Let's grow money together!

My Gems! On a mixed day, wouldn't you be as happy as me to see your portfolio is on the positive side? Am I good? Or am I just lucky? I really wonder too. Just last month, I was so depressed about my losses. Recent weeks my new trading system works damn well. Back to the gems. ST-Eng and Jur Tech are having down days. Both had their weekly chart still having buy signal. For ST-Eng, it is actually a chance to buy more. As for JurTech, I choose to stand aside, as the daily chart has somemore downside as it's stochastics is in overbuy.

Wednesday, July 13, 2005

Market Tua Cheong ah!

Vol 1115.6 M, Val 1071.3 M

Rise 365, Fall 147

Winners thrashed losers today yet again. A continuation of yesterday's trouncing. Check out the volume and value!!! No joking matter man. So I guess the bradley turn date is for the better than the worst. Again my gems posted gains or stood level. I'm not overly satisfied as the ratio for winners is 3:1. So unless you are running on bad luck, it's difficult to lose today. Many had warned about the high oil price, but I still don't see our market reacting to it ever since last week. Special mention about tech stocks is a must today. It seems like sentiment about the reversal in tech stock is very strong these days. The tech stocks has been running for weeks. I'm waiting for the next down to get vested. Retracement is a must to keep an uptrend healthy. So beware of catching stocks at their highest point.

On a day like this, I'm pleasantly surprised that my HGM actually went up to 0.480 before closing at 0.475. The world's steel price has fallen so it had no doubt affected the margin of HGM. However it must be noted, marine books are full and HGM's business mainly supply marine ship metal. Also, due to the over supply to demand situation in steel industry, output has been curb. Soon, we shall see steel price firming. This is just my hindsight and should not be taken as a reason to get vested in HGM.

The whole nation is talking about the NKF saga today. But i'm more concern that SPH has dropped 10 cents today. However i'm not too concern. From a technical point of view, the weekly trend is still up. What i see is a chance to add on my holdings if the weekly uptrend continues on a down day.

Two counters Jaya Holdings and Rotary was alerted from my system. I have posted the charts. This makes my gem list exploded to 8! What a good number. Auspicious! :D

Suntec Reits, really getting disappointed in this fella. It has close under resistance. I wonder if this is man made or is the sentiment really bad. One must note that Mr Lee KS has sold some of his holdings in Suntec Reits. Maybe it's time i consider to let go mine as it seems to be weak at the moment from a T.A point of view.

Unifiber, still yet to make it's move. Another heavy volume day today with big lots buy up. Soon...soon it will cheong...I must have the patience and trust my system. Sesdaq is having a fine run. Unifiber should join it soon.

Tuesday, July 12, 2005

Gems continue to Tango!

I wish to bring to your attention, my ex gem Hi-Pi. As soon as I dropped it over the weekend, it replied defiantly today with a +0.08 gain! I drop it because the weekly MacD is flat, trendless. It was initially thought to be smart to get out fast before it ticks down. Instead it ticks up! My cut loss was never triggered yet I drop this gem. What I did wrong here was to guess that it is turning down. Next time I shall wait for it to turn down as a confirmation. It's most satisfying that Jurong Tech continues to grow north! It's my new pick over the weekend and it justified that my system works! How wrong can I be? I mean so far all the gems generated from my systems rocked! Why should I not trust it? My gems are counters that are not yet overbought and have not cheong yet. Hence the risk/reward ratio is good.

This brings enough courage for me to cash trade for the first time in weeks.......I got vested in Unifiber today. In my chart reading yesterday(scroll down) I saw the weekly trend flattening...so I thought it should move either upwards or downwards very soon. Who would have expect it to cheong northwards on a hefty volume! The resistance 0.395 was overcame with such vigour that I joined the rally. Let's hope this is the first cash win for my system! :D

As for the market, it's quite a tight race today with the bulls winning by a slim margin and STI slightly down 5.6 points.

Vol 907.4 M, Val 793.6 M

Rise 254, Fall 209

Sesdaq, our pennies on the other hand posted gains and flooded the top active list. Time to grab some cheap lobangs? Tomorrow is bradley turn date in Astrology. It means something is coming. It could be good or bad for the market. Let's just watch. I don't do astrology analysis, i'm merely quoting a source just for my curiousity sake how Astrology Analysis works. A bomb went off in Barcelona but the damage is pale in comparison to London. Hence no impact on market so far. In a market where you have a 50% chance of on the losers side, my gems are on the winners side. Another strong evidence that I should trust my system.

And by the way, please read about NKF vs SPH. From this saga, I have decided to stop my monthly contribution to NKF. I be happier buying more tissue paper from the handicapped or donate directly to old folks home or any other place. This is my personal opinion and decision, i just need to express my disgust that's all.

Monday, July 11, 2005

Jurong Tech Spot on!

Vol 714.9 M, Val 729.8 M

Rise 340, Fall 133

The market was boosted by lower oil price, US market rally and the better than expected manufacturing data. The 2H GDP was also adjusted. Ever since I lost my last trade in June, I turned so wary abt STI retracement that I missed some good opportunities.

Am I being too *hum ji? Isn't chasing after the high price now an act of the fools? The sellers would be people who had bought at low and they sell at high. By buying now, would I be doing a buy high and later sell low? Or will it be buy high and sell higher? Mathematically, it just doesn't give me the good odds to chase after the high price. But emotionally, my gut feel say to bet on it. This is a trap! I followed my gut feel and lost heavily in the market. So this time, I shall just stand aside and let the bulls run. The only sure way of higher winning odds is buying when the market is oversold. Right now, it's obvious that it's so overbought.

A fellow Astrology Analysis trader had informed me about a bradley turn date on 13th July 2005. This turn is negative for the market before a strong astrology power presents itself on 18th July 2005. I included this astrology analysis in only for curiousity sake as i am still trading on T.A. However it must be noted that "Kong Ming" used astrology alot. haha!

As for my gems!!!!! *drum roll* Perfect! You should see the table I posted. All in positive territory and only 1 in negative territory. Maybe it's not a surprise since the winners to losers ratio is about 3:1. You have to be really unlucky not to be on the winner list. But! My gems has overcame the see-sawing of last week and stood firm at last week's closing. They are not affected by last week's massacre, where the likes of Cosco, noble got shot down. Simply, they are stable trades to make.

Alright, now that my trading system is working fine for me. I should be ready to go for the jugger soon. I shall announce the trade if i ever make one. I'm currently toying with the idea of trading warrants. You can see from my post of the Jurong Tech warants. Cheap and lucrative. I hope luck smiles on me this time.

src="http://pagead2.googlesyndication.com/pagead/show_ads.js">

Sunday, July 10, 2005

London Bombing brushed aside!

Hi-pi would be removed from my gem list because the trend indicator has flattened out and thus no more trend. Another reminder, do not use trend following indicator on counters that are not in a trend. It is most inaccurate and suicidal. Jurong Tech made it's way into my list. I have a chart posted for the reasons why it is enlisted. If you feel otherwise, please leave a comment. Let's learn together! As for the rest of the Gems, they continued to show prospect, infact i am about to trade cash for the first time in a month! The risk reward factor for unifiber is just too enticing for me. But the big wall at 0.395 is a major concern. But once it is broken down like Berlin wall, no holds bar, all the way to 0.50! hehehe (0.50 is my dream, not a target price in T.A) ST-Eng had announced a much better Quater than expected on Friday. No wonder the share price keep going up. Using Technical Analysis (T.A) I had spotted the pick up 1 week before the results and is now sitting on paper profit. Now, who says Technical Analysis doesn't work? haha T.A indicators shows the buying and selling intensity. So any insider trades are picked up. They are not just used to measure history chart patterns. It's a whole tool box. It depends on how you use them. I must continue to polish my T.A skills. Any mistakes in T.A will be recorded here as well, so that you my friend, do not make the same mistake. If you don't make mistakes, there's only 1 way your capital will go, NORTH! : )

Thanks guys for visiting my site. This site came alive because of your participation. Your chart requests enable me to practise more chartings and also an opportunity to unearth hidden gems. However, I urge more participations through the shoutbox on the left, and leaving your technical comments on my charts. This way we can really learn together like a big community. I am compiling a list of top 10 CPF investment counters from SI forummers. Shall share with you here. Let's grow money together!

You should have noticed a difference in the site today. I added trading advertisements incase you are interested in some products, you can click the links there. There is also a google search bar for you to use when you had parked your browser at my page and wished to get information elsewhere.

Last but not least, I am continuing to grow this community. You can help me by forwarding my URL to fellow shares fanatics. Fellow traders from friendsters, I hope you can share your thoughts or picks on the share market here as well. Sorry if I spammed your inbox. : )

*As traders, we are lonely because the people next to us doesn't understand our ups and downs in emotion because of the market.

Thursday, July 07, 2005

Terrorists Strike Again! Ta ma de!

With this latest strike on London, it reminded me of the Madrid blast last year. I have posted the charts of sesdaq and STI to see what happened to our market in the aftermath. Both index opened down and then close higher. Will history repeat itself? For the brave hearted, you may want to contra when it open lower. But for amateur like me, let's stand aside and observe.

Our market really got massacred,

Vol 718.2 M ; Val 943.2 M

Rise 171 ; Fall 320

This time the sell down is fast and furious and thick with volume. With the London blast factor, tomorrow is almost confirmed a bad day. US already started trading in negative territory. But all is not lost! Amazingly, my 4 gems survived the massacre today. They are left untouched! But I have my doubts in tomorrow's session. God damn the terrorists!

We already have Economy slow down and high oil price to worry about. Now with the resurfaced Terrorist factor, i wonder how long it will continue to weigh down on market. All analysts no matter how thorough your fundamental analysis or technical analysis is, you will never be able to avoid a catastrophe in the form of natural diasater or terrorists attacks. Hence cut loss is important. Isn't it ironic? I have been talking abt discipline and important of cut loss, yet I still holding on to HG-Metal. I'm psyching myself up for that.

If you enjoy reading and find my postings interesting, you can forward my blog address to all fellow traders who share the same passion like us. The more the merrier so that we can have a big pool of traders to offer good advice and comments on the charts posted.

Wednesday, July 06, 2005

STI rocks on!

Now I know why i lose money last year. I have been chasing shadows! I have noticed how Olam and MMI rose prior the release of positive corporate news. How on earth do those people seemingly know about the news and then buy before the announcement? When announcement is out, price will jump higher, innocent and naive people like me will jump in. But as soon as we get vested, those who bought prior to the annoucement will take profit and cause the share price to slide lower. Experts buy low and sell high. Novice will buy high and sell low. If we were to use Technical Analysis, we can pick up the buy signal together with those who knew the news. This reinforce my believe that Technical Analysis works. But if you have holding power like Mr Buffett, it's better to be a investor as you can sleep more peacefully. Though, less exciting. haha

My 4 gems,

SMT: bought 0.715; price now 0.720

Hi-pi: bought 1.45; price now 1.45

ST-Eng: bought 2.47; price now 2.51

Unifiber: bought 0.390; price now 0.385

All the above gems are still "up" on the weekly chart hence I stayed long. It's still a mixed performance. Let's see how it close on Friday.

Another darling.....SPH! shiok! This one i stay vested since last June! Today it upped 8 cents on a heavy volume! : )

I am going to cut HG Metal....very soon.....I have to bite the bullet and face the harsh reality.

Tuesday, July 05, 2005

Unifiber to rumble soon?

13th July is a turn date according to Astrology analysis. Let's see if it comes true. I remember last time Zhuge Liang the great used to study Astrology to aid his combat tactics.

Penny stocks has really been flying of late. Refering to the charts on sesdaq and STI, it's easy to see why. The bullish divergence could be happening right in front of our eyes.

HGM, why am I still holding on to this hopeless counter? Emotions. It will be a very painful loss after holding this counter for nearly 7 months by now. Fundamentally, steel prices has dropped. Technically, the chart look damn bad. What am I still hoping for? I should cut....I should cut....

I have been alerted to buy MMI of late. But I didn't. I decide to stick to my trading system and give it a miss because I promise myself never to buy on rumours again after I got hit few months ago. Now I'm looking stupid. MMI has rocketed off and laughing at me from the north. I just have to keep trying, keep learning....it has been almost 1 year since I started to write my trading journal. Looking bad, I keep making the same bad trading mistakes. With this new blog, it's a new beginning. I will be a better trader. By working hard learning, there's only one way I can go, that is Improvement!

Monday, July 04, 2005

Satisfying showing by 4 Gems!

In a session where winners win the day marginally, I'm very happy that my 4 Gems performed! On any other day, I'm sure i will be on the loser side man! This time round I have sticked to my plan stringently.

- SMT : 0.695 cut loss - close at 0.710 today, it was a no buy today as the open interest was not strong. Now, the weekly macD chart seems to have hit peak. Stand aside is my decision until MacD ticks up

- hi-pi : 1.43 cut loss - close at 1.460 today, up a cent. But during intraday it touched 1.48. Hold now as force index crossed above zero line.

- unifiber : 0.375 cut loss - close at 0.390, maintain buy and cut loss price. Force index still under zero and Stochastics in oversold. Great potential.

- ST-eng : 2.41 cut loss - the star of the day, with a 3 cents profit performance! Weekly MacD and daily Force Index all read as positive. In addition, it released a new contract deal today after trading hours. Surely more upside tomorrow.

US bourses having holiday today. I came to realise, despite the oil price trading at US$60 region, our market has been ignoring it and keep edging higher. While I was all the way cautious last week, it was stupid of me. I should follow the market and the trend. Who am I to predict a massacre in SGX just because of high oil price? I remember sometime last year, oil price was deemed high at US$39 and I was also cautious abt trading. STI was less than 2000 then. I posted something like "Getting used to high oil price". It's somewhere in my old blog. Didn't STI still climb all the way to current level of 2200 region?

Now back to present, with so many analysts already expecting a higher oil price come year end, will this be factored in in the price we are seeing now? So would it means stocks will continue to climb like last year since it won't come as any shock? Any comments?

Sunday, July 03, 2005

4 Gems Spotted!

I have been diligently reading T.A and trading psychology book over the weekend. I come out enriched! Am so very glad to understand T.A better. What are traditional chart patterns, what are oscillators and trend indicators. You do not use trend indicators on counters that are in trading range. To trade using oscillators, it will mean nimble hands where you will get out of the market as soon as it hit over buy. Over-staying kills! My current trading system is using trend indicator on the weekly chart followed by oscillators on the daily chart to pin point buying opportunities. Here's a look at what I have found! : ) Cut loss level is important! In the game of trading, money to us is oxygen to divers, we must manage it well inorder to survive!

- SMT : 0.695 cut loss

- hi-pi : 1.45 cut loss

- unifiber : 0.375 cut loss

- ST-eng : 2.41 cut loss

Let's see how they perform for the week! I resolve to continue to finetune my chart reading my combining traditional chart patterns + candlesticks + western indicators!