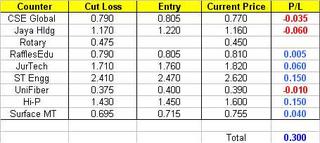

Decipher Gems: suffer a setback when Jaya Holdings and CSE faced some serious sell down. However overall it's still a +0.30 gain. Jaya Holdings, Rotary and CSE will be taken out of the list as their weekly trend have turned down.

UniFiber:

I sold unifiber on Friday. It's a really stupid decision on my part because I did not follow my rules. I decided to cut loss after it dipped to 0.385 on intraday trading but it closed at 0.390. On the chart it's not a sell signal. The previous day closing was down 1 cent and it affected me a great deal. I have commited this mistake hell lot of times. If unifiber cheong this coming week, i'm going to bang balls!

Junma: Due to the revaluation of the Yuan, this china play could be the next to move up. It's supply rubber for car tires. If it can import materials to make tire cheaper, it's margin will improve. I'm not sure how true and am not very familiar with it's business. But it pays to pay attention to this. Chartwise it has been lying low for sometime now. Just keep it in the watch list and not a Decipher Gem due to it's lack of market interest. Just found out, Junma's business is in china only. Yuan evaluation can only be helpful if they import raw materials. So they can have a more comfortable margin potentially if they import their materials from overseas.

Full Apex as requested.

As for my comments on HGM,

What is the business risk of HGM? Demand of Steel and Steel prices. Falling steel price is thought to be due to supply over demand. Steel production will slow down to curb the current situation, thus causing the price to stablise. After that steel price will go up! Because the demand is still strong. Construction is happening everywhere. Marine sector is still flourishing. They need steel plates for ship repair. New Oil Rig orders fills the news every week. All these are build on steel and not plastic or rubber. So i conclude Demand for steel is still strong while price of steel will stay stable. HGM's earnings will continue to stay strong as long as demand of steel is there. Wait for me dudes, i'm going to study the last steel cycle and see the similarities and differences. After that, i will share again.

As for the share price, it lacks market interest. I suppose HGM is seen as a small stockist out there.

By the way, i'm IT analyst hor, not economy analyst! hehehe so any expert please comment. Thanks!

My comments for Suntec Reits:

I suppose Suntec Reits is poised to take full advantage for it's office rental business when office space starts to get expensive in Singapore. It was reported that office space in Singapore is still considered at it's low. So chances of upside is unlimited. With it's close proximity to the 2009 Casino and the MRT to be built right next to it, this fella should be worthwhile to collect. Recent share price volatility should not be of much concerned if you plan to hold it long term say 5 to 10 yrs. Let's not forget about the properties it acquired recently. Once office rental hots up, Suntec will be mentioned time and again.

I hope market gurus out there can comment and teach me a thing or two if i am wrong in my analysis. Thanks in advance!