Tonight I present a list of stocks that is near or at it's 52 weeks low with weak RSI. These stocks are weak. For any rebound in them, it will be useful to judge by T.A if the rebound is weak or strong before we can short sell it. Here I am talking about short selling with CFD or SBL account. Definitely not an invite for naked short.

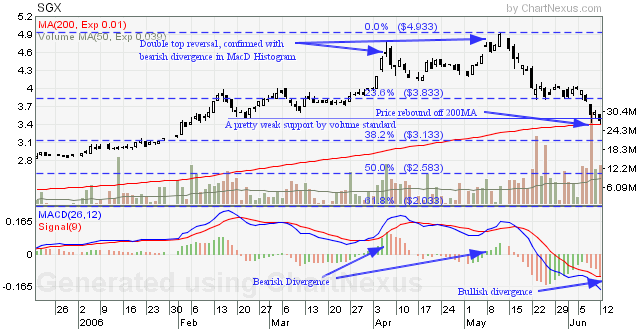

There is still no strength in the market. I didn't like the way it slipped under the 200MA. Now it has deviate from my anticipation and I have changed my view. To me, it looks like a short sell on a rebound above 2400 or even 2500. The key thing to watch out will be follow through buying and volume. Most importantly, we must watch how it performs when the rebound has peaked.

Stocks at or near 52 weeks low with weak RSIAllcoReit ((Price at/near historical low 0.86))

BOC MBL eCW070108 ((Price at/near historical low 0.285))

BrightWor ((Price at/near historical low 0.395))

CapitaMall ((Price at/near historical low 2.15))

ChinaEssen ((Price at/near historical low 0.49))

ChinaFlexP ((Price at/near historical low 0.39))

ComfortDelGro ((Price at/near historical low 1.43))

Fabchem ((Price at/near historical low 0.46))

Full Apex ((Price at/near historical low 0.27))

Gen Int ((Price at/near historical low 0.325))

Hi-P ((Price at/near historical low 0.985))

Hyflux ((Price at/near historical low 2.3))

JurTech ((Price at/near historical low 1.0999999761581427))

LMA Intl ((Price at/near historical low 0.69))

MacqIntInfra ((Price at/near historical low 0.83))

MapletreeLog ((Price at/near historical low 0.885))

Meiban Gp ((Price at/near historical low 0.245))

MMP Reit ((Price at/near historical low 0.905))

Noble Grp ((Price at/near historical low 0.96))

Pacific HC ((Price at/near historical low 0.235))

Sing Tel ((Price at/near historical low 2.33))

SPH ((Price at/near historical low 3.98))

Star Pharm ((Price at/near historical low 0.42))

StarCrusUS$ ((Price at/near historical low 0.195))

THBEV ((Price at/near historical low 0.26))

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.