With the not so good closing of STI yesterday, it should be smarter to be more alert today. I still see many stocks as tiger head, snake tail...beware. Tonight i spent alot of time looking at 1998 and 2002 STI's performance. Familiar years? Yes they are the world cup years! haha

Market always decline after world cup...i do not have the data for 1994 though. In 1998 we have the infamous Asian Currency Crisis so it might be the reason. But there is no crisis in 2002. During the World Cup Finals which was also the School Holidays, Trading volume will be expected to be very thin. While this will make trading difficult, but it is also a good time to load up good stocks on weakness.

Then i also look at past elections. 1997 and 2001....woo...again both time market rally up to 4 weeks after elections and then start to correct. This is something to look out for. And of course, before elections market is always up.

Summary, after our Elections, watch for signs for weakness. Also, while you didn't forget to cut loss over the last few retracement days, did you forget to buy? : )

GrowMoney QuickPick

Stock: Line of least resistance

Biosensor: 1.24

Superkopi: 0.620

GlobalTest: 0.370

SembCorp: 3.62

Metro: Bottom Fishing

MMI: Bottom Fishing

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Welcome to my trading journal! A place where I share my Psychology, Money Management & Trading system on trading shares in the Singapore Stock Market. Fellow shares enthusiasts are welcomed to share thoughts too. I hope my posts will be educational to you in your quest to growmoney. I can be reached at eehwa.ng@gmail.com outside of the blog.

Thursday, April 27, 2006

Wednesday, April 26, 2006

Stock Market could continue upward momentum

I am back! Looks like market is going to give me a big welcome tomorrow! haha Just nice for my return! hehe Look at my article on Thursday, April 20, 2006. That day i saw many warning signs on the many charts i scanned hence i ought to warn in this blog. Hence, you saw the article was not your usual quickpick list and instead it contained bearish stocks and stocks that might interest you.

I don't rely just on blueline alone. There are many other weapons in my arsenal. It is important that you apply different strategy for different times. When i did my scan during this week, at the back of my head was the down days since last Tuesday...hence instead of searching for blueline stocks, i began to hunt for bottom fishing. When market was red hot few weeks ago, i scan for blueline stocks because i saw many stocks breakout of 52 weeks high from sound bases. Flexibility and knowing the market condition is important.

Tonight, no interesting chart to draw but i'm sticking to my analysis on sunday night where i drew many charts in anticipation of what will happen this week. Quickpick list returns tonight and other than the all time favourite of blueline, we now have bearish stocks and also stocks that could be doing a reversal.

Again i would like to rally for appreciation from you my dear friends to continue support this blog! It is your undaunting support that motivates me to deliver value and priceless information at your fingertips. Please don't just come, take and go everyday! Do something!!! :P

GrowMoney QuickPick

Stock: Line of least resistance

AsiaPower: 0.345 (Slow moving stock though)

TatHong: 1.06

Sembkim: 0.635

SembMar: 3.20

Stats: 1.34 (If Nasdaq behaves tonight, why not?) :D

UTAC: 1.02 (Powers ahead with volume, can try but make sure you are willing to cut loss if wrong)

DBS: 17.40

Kepland: 5.05

Luzhou: 0.715

Reversal:

Federal

Ho Bee

Bearish:

AllGreen

BeautyChina

MediaRing

SPC

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

I don't rely just on blueline alone. There are many other weapons in my arsenal. It is important that you apply different strategy for different times. When i did my scan during this week, at the back of my head was the down days since last Tuesday...hence instead of searching for blueline stocks, i began to hunt for bottom fishing. When market was red hot few weeks ago, i scan for blueline stocks because i saw many stocks breakout of 52 weeks high from sound bases. Flexibility and knowing the market condition is important.

Tonight, no interesting chart to draw but i'm sticking to my analysis on sunday night where i drew many charts in anticipation of what will happen this week. Quickpick list returns tonight and other than the all time favourite of blueline, we now have bearish stocks and also stocks that could be doing a reversal.

Again i would like to rally for appreciation from you my dear friends to continue support this blog! It is your undaunting support that motivates me to deliver value and priceless information at your fingertips. Please don't just come, take and go everyday! Do something!!! :P

GrowMoney QuickPick

Stock: Line of least resistance

AsiaPower: 0.345 (Slow moving stock though)

TatHong: 1.06

Sembkim: 0.635

SembMar: 3.20

Stats: 1.34 (If Nasdaq behaves tonight, why not?) :D

UTAC: 1.02 (Powers ahead with volume, can try but make sure you are willing to cut loss if wrong)

DBS: 17.40

Kepland: 5.05

Luzhou: 0.715

Reversal:

Federal

Ho Bee

Bearish:

AllGreen

BeautyChina

MediaRing

SPC

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, April 24, 2006

Record Crude Oil Taking the shine of stock market

aHigh oil price is finally taking toll on the market. I would still think it's a normal retracement after a crazy run up. For the pennies, it has been a straight 4th sessions of decline. I am seeing selling drying up in some counters. After my analysis, it seems more like a mixed session than the 419 losers vs 200 gainers. I am not bearish as yet.

Don't worry, I will still be updating my websites every night although i am not available during daytime. It's no open secret that it is what we do after 5pm that determines our wealth! In fact, i see end of day analysis more important than trading hours. Trading plans should be formularised before market starts and you should stick to it.

Newbie, Yoyo is right, I have sold my mediaring since last week! keke Last week got voices telling me to take profit and not to be greedy. hahaha

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Don't worry, I will still be updating my websites every night although i am not available during daytime. It's no open secret that it is what we do after 5pm that determines our wealth! In fact, i see end of day analysis more important than trading hours. Trading plans should be formularised before market starts and you should stick to it.

Newbie, Yoyo is right, I have sold my mediaring since last week! keke Last week got voices telling me to take profit and not to be greedy. hahaha

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, April 23, 2006

Stock Market at High Volatility Mood

After doing my analysis, i realised there are quite a number of bearish signal on some charts. I am unclear about the direction of penny shares. Perhaps only selective stocks will be strong. It's time to watch your profits closely! We must not ignore that crude oil is at it's historical highs. If it can drag the market down in 2004...it can do the same this year.

I caught some questions in my shoutbox and would like to clarify. Elizlow was asking why did i say chart nice on thursday and then say not nice on Friday? When i was talking about thursday is refering to the weekly chart of sunray. At 0.520, it looks like a breakout of 0.540 was coming. But we all know it didn't happen, and in the end it closes at 0.490 on Friday inline with my warning. The warning serve for Friday only because i could see reversal on the cards hence serves only as warning. You can imagine how those people who bought at 0.520 is feeling now.

I have included a whole list of charts and our favourite blueline theory below. I will be busy over the next 3 days so you won't see me in the shoutbox. Even though i'm not around, if my blog has helped you grow money or learn some technical analysis, i hope you can return me the favour hor. If really no ones supports, my blog will go bust! :D A great way to pay "subscription" ma...no need to come out from your pocket leh!

GrowMoney Quickpick

Stock: Line of least Resistance

DBS: 17.40

SembMarine: 3.2

Stats: 1.33

TechOil: 0.835 (Trading Halt, positive news, may gap up)

CAO: Support at 1.28..great catch if can get.

AddvHoldings: support at 1.42

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

I caught some questions in my shoutbox and would like to clarify. Elizlow was asking why did i say chart nice on thursday and then say not nice on Friday? When i was talking about thursday is refering to the weekly chart of sunray. At 0.520, it looks like a breakout of 0.540 was coming. But we all know it didn't happen, and in the end it closes at 0.490 on Friday inline with my warning. The warning serve for Friday only because i could see reversal on the cards hence serves only as warning. You can imagine how those people who bought at 0.520 is feeling now.

I have included a whole list of charts and our favourite blueline theory below. I will be busy over the next 3 days so you won't see me in the shoutbox. Even though i'm not around, if my blog has helped you grow money or learn some technical analysis, i hope you can return me the favour hor. If really no ones supports, my blog will go bust! :D A great way to pay "subscription" ma...no need to come out from your pocket leh!

GrowMoney Quickpick

Stock: Line of least Resistance

DBS: 17.40

SembMarine: 3.2

Stats: 1.33

TechOil: 0.835 (Trading Halt, positive news, may gap up)

CAO: Support at 1.28..great catch if can get.

AddvHoldings: support at 1.42

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Thursday, April 20, 2006

Contra players on the way out of market!

Growmoney quickpick list has generated fewer and fewer stocks over the last week. I have mentioned how i struggled to find stocks from well defined chart bases. Infact the list got shorter on Wednesday night with only 4. This is consistent to what I have read, when there are no more well defined base consolidating, the market has already run up.....the next phase of correction will sets in. That's where the chart bases will form again.

The explanation is simple, with many stocks already broken out from chart bases, the supply of buyers will run out. This is what happened when many of them retraced. If there are supply of buyers, the stock will go up and not down. When there are no buyers, Sellers will appear and when stock declines, more people join in the selling. This basic understanding is a must to know. Last Thursday/Friday market rallied, many contra players have to sell this week. Some of the counters i have glanced through retraced with light volume...that is cool. Market or rather your stocks have to rebound with volume! Otherwise be very careful. I will also look out for bargain hunters to return tomorrow. If there are no bargain hunters, there could be more downside.

Remember, preserve your capital, cut if you must, there are plenty more chances of making it back!

I also want to warn...be very careful of what you read in the shoutbox during trading hours, my blog has a large following...some evil do'ers might make use of us to help push a stock up for him to dump. Becareful if you see anyone over promote a stock. Take it with a pinch of salt. Also do not disclose the price level you bought in the shoutbox, cannot let the enemy know your trump card.

I think the list below is really badly wanted!

Stocks to be careful of:

Sunray

Stamford Tyres

Sinopipe

Rotary

MemTech

Meghmani

LuxKing

Jadason

Hongwei

Innovalues

Golden Agri

Eucon

Darco

DBS

CG Tech

C&O

Biotreat

Ausgrp

AsiaPharm

Asia Tiger

Asia Power

Ace Achieve

Stocks you might be interested:

SPC

Thomson Medical

Swissco

Sembkim

Courage Marine

TatHong

Hongkong Land

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

The explanation is simple, with many stocks already broken out from chart bases, the supply of buyers will run out. This is what happened when many of them retraced. If there are supply of buyers, the stock will go up and not down. When there are no buyers, Sellers will appear and when stock declines, more people join in the selling. This basic understanding is a must to know. Last Thursday/Friday market rallied, many contra players have to sell this week. Some of the counters i have glanced through retraced with light volume...that is cool. Market or rather your stocks have to rebound with volume! Otherwise be very careful. I will also look out for bargain hunters to return tomorrow. If there are no bargain hunters, there could be more downside.

Remember, preserve your capital, cut if you must, there are plenty more chances of making it back!

I also want to warn...be very careful of what you read in the shoutbox during trading hours, my blog has a large following...some evil do'ers might make use of us to help push a stock up for him to dump. Becareful if you see anyone over promote a stock. Take it with a pinch of salt. Also do not disclose the price level you bought in the shoutbox, cannot let the enemy know your trump card.

I think the list below is really badly wanted!

Stocks to be careful of:

Sunray

Stamford Tyres

Sinopipe

Rotary

MemTech

Meghmani

LuxKing

Jadason

Hongwei

Innovalues

Golden Agri

Eucon

Darco

DBS

CG Tech

C&O

Biotreat

Ausgrp

AsiaPharm

Asia Tiger

Asia Power

Ace Achieve

Stocks you might be interested:

SPC

Thomson Medical

Swissco

Sembkim

Courage Marine

TatHong

Hongkong Land

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Wednesday, April 19, 2006

Stock Market At Historical high!

There were plenty of bearish stocks and many blueline retraced. Attention were at STI component stocks. The overnight big rally of US market spured the region on and we closed at historical high. Penny shares might not return to the limelight so soon. Tonight's homework yield no good stocks for quickpick. However i tried to use T.A to bring to you the probables.

Oil plays went muted again today. It seems like a one day wonder where they surged in price and volume. Let's see what tomorrow brings.

GrowMoney QuickPick

I noticed too many people had no trading plan when they put on a trade. Remember, this is a sure way to lose control. Quickpick list highlights stocks to you and you must study it and devise a plan before you put on a trade. There are 700 over stocks, and this list shows you what I am looking at.

Hongfuk

Labroy

Rotary

Sinomem

Sunray (Watch...Weekly chart very swee)

Thomson Medical

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Oil plays went muted again today. It seems like a one day wonder where they surged in price and volume. Let's see what tomorrow brings.

GrowMoney QuickPick

I noticed too many people had no trading plan when they put on a trade. Remember, this is a sure way to lose control. Quickpick list highlights stocks to you and you must study it and devise a plan before you put on a trade. There are 700 over stocks, and this list shows you what I am looking at.

Hongfuk

Labroy

Rotary

Sinomem

Sunray (Watch...Weekly chart very swee)

Thomson Medical

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tuesday, April 18, 2006

Stock Market tangoes Traders and Investors

Pardon me for my broken English used here as i cannot be bothered to correct it as long as you can understand. haha Late night leh, just wanted to quickly share my observations. E-books are written over time hence I have the time to use my best English my teacher ever taught! haha Anyway, market was unbelievable! Intra day selling was well abosrbed and like a wave, counters were pushed much higher in the afternoon. 1 sector to note was Oil, Gas Play are in. Did you saw how oily the day got? haha I posted on Sunday night saying i smelt consolidations in oil plays and bingo! Just like when i anticipated a move in property in Jan'06, i hope my yahoo group members still remember. Judging from the volume, it looks great. Let's see the true colours of them tomorrow!

Aiyo, when you are happily making money hor, don't forget about Decipher hor, e-books, charts, quickpicks, live chats... i done my best! keke so can you please....err....erm.... :D Must remember this blog is monetised by??? haha

Look back at my list of quickpicks, power man!!!! :D Sometimes i really wish i have the time to just seat here and trade. : ) But with a small capital, i know i cannot expect to win so much at a time. It's simple, 10k's 100% is 10k while 100k's 100% is 100k which can sustain a lifestyle in Singapore. Hence i still have to continue to be an employee and save the hell out of my pay to get that dream capital to be a Trader!

Rotary: Remember it's $500 million deal on Jurong island? I always believed it's story not over yet...let's see how it performs tomorrow as 0.590 seems to be a tough nut to crack.

TiongWoon: This chart should be read together with the last Tiong Woon chart i posted. You should observed that price retraces with light volume. While i may have to cut my ChinaWheel (Buy 0.445; sold 0.335) I got into TiongWoon as it breaks out. : )

Zhonguo Power: Volume retraces with light volume after breakout, look at Tiong Woon's chart. If my anticipation is right, once 0.380 taken out convincingly, it will be a powerful one.

GrowMoney QuickPick

Stock: Line of least resistance

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

MemTech: 0.345

Cosco Corp: 1.32

AusGrp: 0.380

AsiaPharm: 0.880

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Aiyo, when you are happily making money hor, don't forget about Decipher hor, e-books, charts, quickpicks, live chats... i done my best! keke so can you please....err....erm.... :D Must remember this blog is monetised by??? haha

Look back at my list of quickpicks, power man!!!! :D Sometimes i really wish i have the time to just seat here and trade. : ) But with a small capital, i know i cannot expect to win so much at a time. It's simple, 10k's 100% is 10k while 100k's 100% is 100k which can sustain a lifestyle in Singapore. Hence i still have to continue to be an employee and save the hell out of my pay to get that dream capital to be a Trader!

Rotary: Remember it's $500 million deal on Jurong island? I always believed it's story not over yet...let's see how it performs tomorrow as 0.590 seems to be a tough nut to crack.

TiongWoon: This chart should be read together with the last Tiong Woon chart i posted. You should observed that price retraces with light volume. While i may have to cut my ChinaWheel (Buy 0.445; sold 0.335) I got into TiongWoon as it breaks out. : )

Zhonguo Power: Volume retraces with light volume after breakout, look at Tiong Woon's chart. If my anticipation is right, once 0.380 taken out convincingly, it will be a powerful one.

GrowMoney QuickPick

Stock: Line of least resistance

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

MemTech: 0.345

Cosco Corp: 1.32

AusGrp: 0.380

AsiaPharm: 0.880

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, April 17, 2006

Stock Market on a roll

Alot of the stocks in my list had breakout of resistances. I prefer not to chase after them and just wait for the next chance to buy them. Buying after a breakout is contary to buying at support, you are buying at high and ought to be careful. Tonight's picklist has been filtered strictly scrutinised.

ChinaPetro became the talking point today. Outstanding! Unfortunately as it happened, i bought another stock instead!! Arggh! haha My stock is in profit hor for my critics...just that it is a pale shadow of ChinaPetro's performance. I am perturbed why did i not buy it. While Chinasun was missed because i was tied up with work. (Work should always come first!!) Chinapetro was there for the taking. It retraces after breaking the resistance and I thought it was a bad sign..when it recovers back to break the resistance I chose a cheaper stock that breaks it's resistance as well. See? Familiar? The bad habit of choosing a cheaper stock! But then again, i wouldn't be complaining if my cheaper stock rallies too! haha But really, this kind of things cannot be avoided so if it happens, so be it, i tell myself, i will get into another good stock soon! Just like in life, if you run got hit by a brick, be glad that you are not hit by a lorry. :D

Labroy again announced new contract but the share price doesn't reflect the good news. Again the whole sector is still waiting to explode....either upwards or downwards! keke

GrowMoney QuickPick

Stock: Line of least resistance

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

CDW: 0.250

LongCheer: 1.11

CGTech: 0.420

SkyChina Petrol: 0.625

Sinopipe: 0.360

C&O: 0.495

Capitaland: 4.96

TiongWoon: 0.340

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

ChinaPetro became the talking point today. Outstanding! Unfortunately as it happened, i bought another stock instead!! Arggh! haha My stock is in profit hor for my critics...just that it is a pale shadow of ChinaPetro's performance. I am perturbed why did i not buy it. While Chinasun was missed because i was tied up with work. (Work should always come first!!) Chinapetro was there for the taking. It retraces after breaking the resistance and I thought it was a bad sign..when it recovers back to break the resistance I chose a cheaper stock that breaks it's resistance as well. See? Familiar? The bad habit of choosing a cheaper stock! But then again, i wouldn't be complaining if my cheaper stock rallies too! haha But really, this kind of things cannot be avoided so if it happens, so be it, i tell myself, i will get into another good stock soon! Just like in life, if you run got hit by a brick, be glad that you are not hit by a lorry. :D

Labroy again announced new contract but the share price doesn't reflect the good news. Again the whole sector is still waiting to explode....either upwards or downwards! keke

GrowMoney QuickPick

Stock: Line of least resistance

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

CDW: 0.250

LongCheer: 1.11

CGTech: 0.420

SkyChina Petrol: 0.625

Sinopipe: 0.360

C&O: 0.495

Capitaland: 4.96

TiongWoon: 0.340

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, April 16, 2006

Stock Market poised for an Election Rally?

The much anticipated elections is finally coming to a school or void deck near you! They always never fail to bring along a pre election rally in the stock market. Watch out for it. Straits Times Index chart shows that it is undecided whether to go further north or south. With elections around the corner, up? Sesdaq is different. The chart is very bullish and it's been marching all the way up since it broke the 100 points resistance. Did you notice what i just said? "Marching all the way up after it broke the resisitance". This is the principle of Blueline theory.

As for sector, did you guys notice, oil & gas play is rather subdued despite crude oil hitting highs near US$70 per barrel. Usually it will lead to a rally in the related industry. A quick check on the charts of these counters, it looks like they are consolidating. I will inform when i notice unusual movements.

While it is very good to see many blogs on the internet giving charts and stocks picks, visitors should always take it with a pinch of salt. Do not follow blindly. Just like the forums, i often see some underhand tactics of promoting a stock after it had been purchased. How did i know? Because when the message was posted, the stock had already ran with limited upside left. Think about it. Also, many bought and then returned to the authors and ask when to cut loss and when to take profit. You are putting yourself at the mercy of these authors. While i always try my best to help, but i feel very worried for people who were following blindly. I am the first to start with a quickpick list back in 2005 and after some fine tuning, i manage to provide you with a before it happens list of stocks. I noticed some blogs have them too recently. But do make sure you scrutinise the lists on every blog including mine and look at it's success rate, risk/reward ratio...etc.. Well for my quickpick list, although there are some who condemned me for making money in a bull market which I don't know why but many of you have encouraged me to continue sharing. I'm sure you can notice how some of the biggest gainers are found right here! I said it many times, i say it again, there is nothing wrong in profitting in a bull market! Why are people scorning and laughing at us? It is still good profits! They say in a bull market even monkeys make money, oh yeah? Try buying CAO, bank stocks? SIA? Will you make over the last few weeks although it's a bull market? Stock selection is important even in a bull market!

I advocate learning with me together and then one day you can trade confidently. Never have I wanted to turn my blog into a crystal ball. If I have that intention, you would not have seen me trying to explain why my blueline theory works and how to make use of it. I prefer to teach you how to fish rather than giving you the fishes everynight. Furthermore, reading and learning with me at my blog is free! Of course i hope you knew what to do to support GrowMoney Blog too. :D

Also, I have published 2 e-books on Trading over the weekend and sent them to my yahoo group. The first book "Charting with Decipher" requires you to do a "CTRL + Click" on the charts for you to view them and you need internet access because the chart is on my blog. The second book, "Decipher's protocols for successful trading" includes my own trading rules which had helped me along the way.

GrowMoney QuickPick

Stock: Line of least resistance

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Technic Oil: 0.765

SSH: 0.315

FerrorChina: 0.925

ChinaLifestyle: 0.315

BioTreat: 1.28

Rotary: 0.570

Fungchoi: 1.04

Hongfuk: 0.65

Suntec: 1.32

MemTech: 0.340

ChinaSky Chem: 1.06

YHI: 0.555

ChinaWheel: 0.44

Sinopipe: 0.360

China Hongxing: 1.40

ZhongGuo Power: 0.370

ChinaPetro: 0.740

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

As for sector, did you guys notice, oil & gas play is rather subdued despite crude oil hitting highs near US$70 per barrel. Usually it will lead to a rally in the related industry. A quick check on the charts of these counters, it looks like they are consolidating. I will inform when i notice unusual movements.

While it is very good to see many blogs on the internet giving charts and stocks picks, visitors should always take it with a pinch of salt. Do not follow blindly. Just like the forums, i often see some underhand tactics of promoting a stock after it had been purchased. How did i know? Because when the message was posted, the stock had already ran with limited upside left. Think about it. Also, many bought and then returned to the authors and ask when to cut loss and when to take profit. You are putting yourself at the mercy of these authors. While i always try my best to help, but i feel very worried for people who were following blindly. I am the first to start with a quickpick list back in 2005 and after some fine tuning, i manage to provide you with a before it happens list of stocks. I noticed some blogs have them too recently. But do make sure you scrutinise the lists on every blog including mine and look at it's success rate, risk/reward ratio...etc.. Well for my quickpick list, although there are some who condemned me for making money in a bull market which I don't know why but many of you have encouraged me to continue sharing. I'm sure you can notice how some of the biggest gainers are found right here! I said it many times, i say it again, there is nothing wrong in profitting in a bull market! Why are people scorning and laughing at us? It is still good profits! They say in a bull market even monkeys make money, oh yeah? Try buying CAO, bank stocks? SIA? Will you make over the last few weeks although it's a bull market? Stock selection is important even in a bull market!

I advocate learning with me together and then one day you can trade confidently. Never have I wanted to turn my blog into a crystal ball. If I have that intention, you would not have seen me trying to explain why my blueline theory works and how to make use of it. I prefer to teach you how to fish rather than giving you the fishes everynight. Furthermore, reading and learning with me at my blog is free! Of course i hope you knew what to do to support GrowMoney Blog too. :D

Also, I have published 2 e-books on Trading over the weekend and sent them to my yahoo group. The first book "Charting with Decipher" requires you to do a "CTRL + Click" on the charts for you to view them and you need internet access because the chart is on my blog. The second book, "Decipher's protocols for successful trading" includes my own trading rules which had helped me along the way.

GrowMoney QuickPick

Stock: Line of least resistance

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Technic Oil: 0.765

SSH: 0.315

FerrorChina: 0.925

ChinaLifestyle: 0.315

BioTreat: 1.28

Rotary: 0.570

Fungchoi: 1.04

Hongfuk: 0.65

Suntec: 1.32

MemTech: 0.340

ChinaSky Chem: 1.06

YHI: 0.555

ChinaWheel: 0.44

Sinopipe: 0.360

China Hongxing: 1.40

ZhongGuo Power: 0.370

ChinaPetro: 0.740

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Friday, April 14, 2006

Decipher delivers his first stock market trading e-book...FREE!

I have just completed my e-book and stored it at my yahoo group

right here --> http://asia.groups.yahoo.com/group/growmoneyblog/files/

It is titled "Charting with decipher"

The purpose of this free e-book is to get you familiarise with how Decipher do his technical analysis. Upon completion of this book, the reader will be familiar with chart patterns and other technical indicators used by me.

I hope you find it useful. : )

For visitors not in my yahoo group, you can download it from here for the next 3 days only.

http://s9.yousendit.com/d.aspx?id=18QL8AWMDV1YO3S9KJNXLOOS30

Happy Good Friday! : )

right here --> http://asia.groups.yahoo.com/group/growmoneyblog/files/

It is titled "Charting with decipher"

The purpose of this free e-book is to get you familiarise with how Decipher do his technical analysis. Upon completion of this book, the reader will be familiar with chart patterns and other technical indicators used by me.

I hope you find it useful. : )

For visitors not in my yahoo group, you can download it from here for the next 3 days only.

http://s9.yousendit.com/d.aspx?id=18QL8AWMDV1YO3S9KJNXLOOS30

Happy Good Friday! : )

Wednesday, April 12, 2006

Stock Market defies regional pressure!

Daily sentiment? Bullish la!! haha too obvious. So tonight's highlight would be the detailed describtion of K1 and Labroy. This should give you an idea of how i manage when my blueline fails me. Of course when it's working, like my media ring, i sit tight tight!!! haha

K1 Ventur: A failed blueline, i cut my loss for a 0.015 loss. But remember i have Media Ring? The stock to me looks like consolidation going on, but i am not going to wait for it. I said, to cut when a stock breaks blueline and retrace without further upside ought to be cut. I am sticking to my system. Also, i checked and found a shooting star on the weekly chart, history shown that whenever a shooting star is spotted, it always retraces. Furthermore, K1 is a very slow moving stock, i prefer fast moving stock. This is done so that funds can be kept liquid and increase the chance of landing myself into another strong counter that breaks blueline and continues to rally.

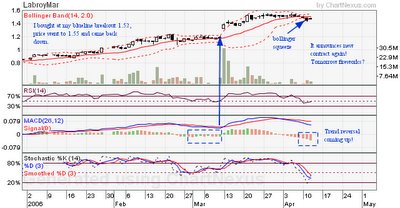

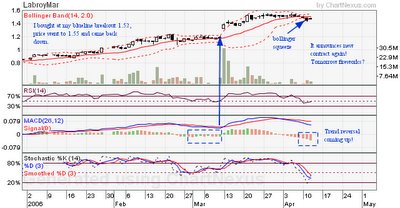

Labroy: When I buy Labroy at blueline breakout, i know i am getting into an oil, gas play. According to my experience, a stock that run up strongly like labroy (from 0.50 to current) must have it's reasons. Remember Hyflux? Cosco? Celestial? Also, recently it transform it's business. Hence i strongly believed it's story is not over yet. I was proven right today when it announces a new contract won! Simple, if it dares to transform it's business, i'm sure they have lots of potential contracts in the pipeline, otherwise why would they risk it? Hence although it failed to clear blueline, retraces, i notice the small volume as compared to history. Hence i hold out. But i was also scared when it was sold down yesterday. But a quick check on the time and sales, looks to me, retailers bailing out. Also my eyes were on indicators...light volume selling and the indicators were heading down ready for a reversal of trend. So my friends, blueline only indicates a scoring chance, you must know your T.A to survive too. Of course, with a new contract it doesn't guarantee a rally tomorrow, but it increases the probability. Let's watch on.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

MemTech: 0.340

Hongfuk: 0.65

C&O: 0.495

ChinaWheel: 0.44

ChinaPetro: 0.740

ZhongGuo Power: 0.370

BioTreat: 1.28

China Hongxing: 1.40

ChinaLifestyle: 0.315

AIM: 0.380

HG-Metal: 0.350

Shanghai Turbo: 0.460

YHI: 0.555

AsiaPower: 0.310

ChinaDiary: 0.650

Eelectrotech: 0.655

TiongWoon: 0.335

PacAndes: 0.855

I was right to cast the net further yesterday. Yesterday's list contained lots of breakouts. Charts were saying bullish while i heard and saw conflicting signals on the news. The news somehow influenced me to be bearish. Hence i stuck to my trading systems and today's breakout was a sweet reward. : ) Never decide what will happen. Just make sure you know how to react when the market gets there.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

K1 Ventur: A failed blueline, i cut my loss for a 0.015 loss. But remember i have Media Ring? The stock to me looks like consolidation going on, but i am not going to wait for it. I said, to cut when a stock breaks blueline and retrace without further upside ought to be cut. I am sticking to my system. Also, i checked and found a shooting star on the weekly chart, history shown that whenever a shooting star is spotted, it always retraces. Furthermore, K1 is a very slow moving stock, i prefer fast moving stock. This is done so that funds can be kept liquid and increase the chance of landing myself into another strong counter that breaks blueline and continues to rally.

Labroy: When I buy Labroy at blueline breakout, i know i am getting into an oil, gas play. According to my experience, a stock that run up strongly like labroy (from 0.50 to current) must have it's reasons. Remember Hyflux? Cosco? Celestial? Also, recently it transform it's business. Hence i strongly believed it's story is not over yet. I was proven right today when it announces a new contract won! Simple, if it dares to transform it's business, i'm sure they have lots of potential contracts in the pipeline, otherwise why would they risk it? Hence although it failed to clear blueline, retraces, i notice the small volume as compared to history. Hence i hold out. But i was also scared when it was sold down yesterday. But a quick check on the time and sales, looks to me, retailers bailing out. Also my eyes were on indicators...light volume selling and the indicators were heading down ready for a reversal of trend. So my friends, blueline only indicates a scoring chance, you must know your T.A to survive too. Of course, with a new contract it doesn't guarantee a rally tomorrow, but it increases the probability. Let's watch on.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

MemTech: 0.340

Hongfuk: 0.65

C&O: 0.495

ChinaWheel: 0.44

ChinaPetro: 0.740

ZhongGuo Power: 0.370

BioTreat: 1.28

China Hongxing: 1.40

ChinaLifestyle: 0.315

AIM: 0.380

HG-Metal: 0.350

Shanghai Turbo: 0.460

YHI: 0.555

AsiaPower: 0.310

ChinaDiary: 0.650

Eelectrotech: 0.655

TiongWoon: 0.335

PacAndes: 0.855

I was right to cast the net further yesterday. Yesterday's list contained lots of breakouts. Charts were saying bullish while i heard and saw conflicting signals on the news. The news somehow influenced me to be bearish. Hence i stuck to my trading systems and today's breakout was a sweet reward. : ) Never decide what will happen. Just make sure you know how to react when the market gets there.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tuesday, April 11, 2006

Stock Market and Regionals Divergenced!

Wow! Thank you people! Yesterday i checked and found many of you rewarded me for my unselfish efforts on this blog. Appreciate it. Thanks! :D

Today STI closes higher despite regional weakness! haha How wierd...isit a trap? A quick check with my daily sentiment analysis showed that, it was bullish! Remember last few sessions has been mixed? Today it was bullish. But with Oil price testing US$70 per barrel...i have my doubts about how long this can sustain. Sometimes i wonder did the US Govt long the oil contract before they confront Iran each time...very lucrative!....hahaha *just for laughs, do not sue me* However do note that the surge in oil price is not due to demand and supply, but it's due to the US-Iran conflict. I saw alot of counters retraced from their highs. This is a warning sign of tired bulls.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

TiongWoon: 0.335

BioTreat: 1.28

ChinaWheel: 0.44

C&O: 0.495

Megmani: 0.385

SembCorp: 3.52

Hongfuk: 0.65

China Hongxing: 1.40

ChinaSun: 0.815

ZhongGuo Power: 0.370

MemTech: 0.340

Seksun: 0.400

ElectroTech: 0.590

LandWind: 0.540

AIM: 0.380

*Tonight i casted the net further, because i ignored WantWant last night and we saw how it brokeout... @#@$@!@@#!

Remember it is not buy all and hope one of them gives u profit! It pays to look at those counters only if it breakouts!

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Today STI closes higher despite regional weakness! haha How wierd...isit a trap? A quick check with my daily sentiment analysis showed that, it was bullish! Remember last few sessions has been mixed? Today it was bullish. But with Oil price testing US$70 per barrel...i have my doubts about how long this can sustain. Sometimes i wonder did the US Govt long the oil contract before they confront Iran each time...very lucrative!....hahaha *just for laughs, do not sue me* However do note that the surge in oil price is not due to demand and supply, but it's due to the US-Iran conflict. I saw alot of counters retraced from their highs. This is a warning sign of tired bulls.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

TiongWoon: 0.335

BioTreat: 1.28

ChinaWheel: 0.44

C&O: 0.495

Megmani: 0.385

SembCorp: 3.52

Hongfuk: 0.65

China Hongxing: 1.40

ChinaSun: 0.815

ZhongGuo Power: 0.370

MemTech: 0.340

Seksun: 0.400

ElectroTech: 0.590

LandWind: 0.540

AIM: 0.380

*Tonight i casted the net further, because i ignored WantWant last night and we saw how it brokeout... @#@$@!@@#!

Remember it is not buy all and hope one of them gives u profit! It pays to look at those counters only if it breakouts!

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, April 10, 2006

Stock Market leaves it till late in the day

After my analysis, i found that my quickpick list getting shorter and shorter. Did you guys realise that? This shows that the natural consolidation/corrections/retracement stocks are running out. We could be seeing the last few breakouts before the turn in the market. Fear not, this turn is only good for a sustained uptrend. As for my daily sentiment scan, market is just slightly bullish. I prefer to stay nimble for now.

There were 2 charts i wanted to highlight today. K1 Venturs and Keppel Land. 2 counters that failed the blueline breakout. I have always shared how blueline worked wonderfully, but today you shall learn how to see the sell signal. Again, blogspot failed me, hence i'm sending to yahoo group.

Anyhow, congrats to all who hold MediaRing! hahaha It is stocks like Media Ring, Midas, Tat Hong...etc...that makes the small loss at failed breakout mediocre. It is not how often you win, it is how much you win when you are correct and how much you loss when you are wrong.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

BioTreat: 1.28

ZhongGuo Power: 0.370

Rotary: 0.595

Tiong Woon: 0.335

AsiaPharm: 0.840 (Make sure you have a game plan when you buy. Stock should not decline, if it does, a failure of breakout.)

AsiaEnv: 0.370

Aqua: 0.845

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

There were 2 charts i wanted to highlight today. K1 Venturs and Keppel Land. 2 counters that failed the blueline breakout. I have always shared how blueline worked wonderfully, but today you shall learn how to see the sell signal. Again, blogspot failed me, hence i'm sending to yahoo group.

Anyhow, congrats to all who hold MediaRing! hahaha It is stocks like Media Ring, Midas, Tat Hong...etc...that makes the small loss at failed breakout mediocre. It is not how often you win, it is how much you win when you are correct and how much you loss when you are wrong.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

BioTreat: 1.28

ZhongGuo Power: 0.370

Rotary: 0.595

Tiong Woon: 0.335

AsiaPharm: 0.840 (Make sure you have a game plan when you buy. Stock should not decline, if it does, a failure of breakout.)

AsiaEnv: 0.370

Aqua: 0.845

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, April 09, 2006

Stock Market Muted tomorrow?

Market will have Dow's big loss on Friday fresh on the mind when it opens tomorrow. From my analysis, market is pretty mixed. Nothing bearish as yet. Also, while i was scanning for quickpicks, i can't help but notice the volume of declines were pretty light accross the board.

As for Zhonguo powerplus, i remember someone shouted breakout on Wednesday, too bad i was busy with work and couldn't reply. This is another example of how blueline really works. I had stated that resistance is at 0.370, we need to break that inorder to see another rally in this stock. Hence it was no buy signal in my trading system. After the 0.355 closing on Wednesday we saw how Zhonguo powerplus retraced.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

Labroy: 1.55

BioTreat: 1.28

AllGreen: 1.60

ChinaWheel: 0.440

United Industrial Corp: 1.41

K1 Ventur: 0.445

CGTech: 0.420

AsiaPharm: 0.840

Thomson Medical: 0.395

AIM: 0.380

Sembkim, MediaRing, Tat Hong, Midas, Chinasun Bio....graduates of blueline! :D

SGX: Even a buy at the breakout $4.00 will still give you profit on Friday. No one expects the heavy selling. One thing i noticed, when the stock is flying high, no one was unhappy and everyone was rejoicing. But when the selling came, confusion was everywhere and people started to question should they hold or sell. That to me is losing control. Before i go into any trades, i have sell rules. Hence when something like that happens, i will be in control.

ChinaPaper: This stock has many people calling for my head. Although i'm away but i have "ears" telling me what happened when i was away! haha Alright, to be serious, this stock has never broken it's blueline and hence no buy signal at all! Hence no way would i have lost money on this stock. Anyway, when you see heavy selling out of the blue and company claimed nothing they knew about it, time to be careful. Remember CAO back in 2004? :P

Everyone wondered where did Decipher disappeared to last Thursday and Friday....well...i was away to a beautiful island called Redang! haha When ChinaPaper and SGX rocked the market, i was undisturbed and resting my tired mind and body at a far away place. keke There...the idlic lifestyle of 2 days though short but proves to be just what i needed! I returned refreshed & full of ideas and raring to go! This is one of my ways to handle stress and look at my life from out of Singapore. Get the bigger picture and then know what to do. Just like a stock, I ALWAYS look at the weekly chart which shows the bigger picture before i look at the daily chart. :D

I have finished collecting my experience into words form and will be sending out a free E-book to my yahoo group and then a very detailed Trading E-book which will be sold via my website. I hope you guys will support me hor. :D More details will be out later...now i need to arrange the passages...

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

As for Zhonguo powerplus, i remember someone shouted breakout on Wednesday, too bad i was busy with work and couldn't reply. This is another example of how blueline really works. I had stated that resistance is at 0.370, we need to break that inorder to see another rally in this stock. Hence it was no buy signal in my trading system. After the 0.355 closing on Wednesday we saw how Zhonguo powerplus retraced.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

Labroy: 1.55

BioTreat: 1.28

AllGreen: 1.60

ChinaWheel: 0.440

United Industrial Corp: 1.41

K1 Ventur: 0.445

CGTech: 0.420

AsiaPharm: 0.840

Thomson Medical: 0.395

AIM: 0.380

Sembkim, MediaRing, Tat Hong, Midas, Chinasun Bio....graduates of blueline! :D

SGX: Even a buy at the breakout $4.00 will still give you profit on Friday. No one expects the heavy selling. One thing i noticed, when the stock is flying high, no one was unhappy and everyone was rejoicing. But when the selling came, confusion was everywhere and people started to question should they hold or sell. That to me is losing control. Before i go into any trades, i have sell rules. Hence when something like that happens, i will be in control.

ChinaPaper: This stock has many people calling for my head. Although i'm away but i have "ears" telling me what happened when i was away! haha Alright, to be serious, this stock has never broken it's blueline and hence no buy signal at all! Hence no way would i have lost money on this stock. Anyway, when you see heavy selling out of the blue and company claimed nothing they knew about it, time to be careful. Remember CAO back in 2004? :P

Everyone wondered where did Decipher disappeared to last Thursday and Friday....well...i was away to a beautiful island called Redang! haha When ChinaPaper and SGX rocked the market, i was undisturbed and resting my tired mind and body at a far away place. keke There...the idlic lifestyle of 2 days though short but proves to be just what i needed! I returned refreshed & full of ideas and raring to go! This is one of my ways to handle stress and look at my life from out of Singapore. Get the bigger picture and then know what to do. Just like a stock, I ALWAYS look at the weekly chart which shows the bigger picture before i look at the daily chart. :D

I have finished collecting my experience into words form and will be sending out a free E-book to my yahoo group and then a very detailed Trading E-book which will be sold via my website. I hope you guys will support me hor. :D More details will be out later...now i need to arrange the passages...

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tuesday, April 04, 2006

Stock Market Trading on the fence

We had a profit taking day. I checked and found that most of the counter did not encounter heavy sell off. My guess is, it was profit taking at work. But it must be noted that most of the counters retreated from their highs. With the index soaring at 6 yrs high, many analysts have called for corrections or retracements. Well, i do agree with them, not that i'm bearish, but retracement is good for a sustained uptrend. Remember we retraced after January'06? People were calling for the big bear? Now look at where we are! : ) As long as i don't see a big bearish candle, i'm confident to continue trading.

GrowMoney QuickPick

Stock: Line of least resistance

Landwind: 0.475

AIM: 0.380

UTAC: 0.985

Electrotech: 0.590

Semb kim: 0.575

Rotary: 0.595

Contel: 0.440

CG-Tech: 0.420

ChinaPaper: 0.525

ChinaWheel: 0.440

Labroy Marine: 1.52

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

GrowMoney QuickPick

Stock: Line of least resistance

Landwind: 0.475

AIM: 0.380

UTAC: 0.985

Electrotech: 0.590

Semb kim: 0.575

Rotary: 0.595

Contel: 0.440

CG-Tech: 0.420

ChinaPaper: 0.525

ChinaWheel: 0.440

Labroy Marine: 1.52

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, April 03, 2006

Stock Market index breaks Resistance again!

It was a wide spread rally today and my holdings are in green! Some very old counters which time and again i have said the chart formation is pointing to a normal consolidation and thus i have refused to sell. Now, i'm rewarded for my convictions. The 2 counters are Media Ring and Rotary. Media Ring has broken out as of last week at 0.345. However, i will be very nimble on Rotary because more often than not, a heavy volume day always lead to another decline as per the chart history. If there is any stock that i think has shown similar controlled pattern would be Sunray. I think the current price is a good risk reward ratio. Support at 0.470 and resistance at 0.540. But if break 0.540, it's a new 52 weeks high. Judging from the strong display today, there should be somemore upside tomorrow...hence look at my quickpicks closely!!!

Let me share a story today. Someone bought Norelco this morning after picking it from my quickpick list. He soon sold for a quick profit of 1 cent because he wasn't comfortable with the way Norelco is trading. Guess what? Norelco stunned him and closes at 0.490. Would I have known Norelco will be so strong? How on earth did i know Hongfok, Midas too ran up so much? This is simply the breaking of line of least resistance at work. Study it, you won't regret.

Did i ever lost on buying a quickpick? Yes. I bought Labroy last week after it broke 1.52 and only to settle and trades between 1.50 to 1.52. Hence i am now sitting on a 1 cent to 2 cents paper lost on Labroy. I will jolly well cut when my contra is due. This is how i use quickpick, when a stock breaks it's 52 weeks high, it should go up further. If it doesn't, CUT! Why bother to hold and hope? There are other stocks breaking out, all we need is get into a runner and it will more than make up for the 1 loss. That to me is a sensible trading plan. An analogy i could draw here is, when you breakup with your first love, do you continue to wait for her/him and hope he/she returns to you? No! You would have moved on and found someone else! So why behave differently in stock market! :D

Rotary's chart

ElectroTech: Reversal sign was detected 15th March 2006. I bought at 0.525 and sold at 0.535 as it was a contra trade. My cash were tight. This is an example of how my small account has to be grown slowly. There is no way i can hold out because i ain't have the money to hold hence when i contra i always close the trade early. This reminds me of my favourite tagline....The rich gets richer. :) I'm sure if i have a larger trading account, the speed of growth will be so much faster as i have holding power.

http://photos1.blogger.com/blogger/1689/1183/1600/2006Apr-AsiaPharm-640x333.jpg

GrowMoney QuickPick

Stock: Line of least resistance

Sunray: 0.540

Labroy Marine: 1.52

Zhonguo Powerplus: 0.370

FerrorChina: 0.895

ChinaWheels: 0.440

AsiaEnv: 0.370

AIM: 0.380

UTAC: 0.985

Rotary: 0.595

Ascott: 1.17

Stats: 1.34

SGX: 4.00

Electrotech: 0.590

ChinaSun Bio: 0.735

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Let me share a story today. Someone bought Norelco this morning after picking it from my quickpick list. He soon sold for a quick profit of 1 cent because he wasn't comfortable with the way Norelco is trading. Guess what? Norelco stunned him and closes at 0.490. Would I have known Norelco will be so strong? How on earth did i know Hongfok, Midas too ran up so much? This is simply the breaking of line of least resistance at work. Study it, you won't regret.

Did i ever lost on buying a quickpick? Yes. I bought Labroy last week after it broke 1.52 and only to settle and trades between 1.50 to 1.52. Hence i am now sitting on a 1 cent to 2 cents paper lost on Labroy. I will jolly well cut when my contra is due. This is how i use quickpick, when a stock breaks it's 52 weeks high, it should go up further. If it doesn't, CUT! Why bother to hold and hope? There are other stocks breaking out, all we need is get into a runner and it will more than make up for the 1 loss. That to me is a sensible trading plan. An analogy i could draw here is, when you breakup with your first love, do you continue to wait for her/him and hope he/she returns to you? No! You would have moved on and found someone else! So why behave differently in stock market! :D

Rotary's chart

ElectroTech: Reversal sign was detected 15th March 2006. I bought at 0.525 and sold at 0.535 as it was a contra trade. My cash were tight. This is an example of how my small account has to be grown slowly. There is no way i can hold out because i ain't have the money to hold hence when i contra i always close the trade early. This reminds me of my favourite tagline....The rich gets richer. :) I'm sure if i have a larger trading account, the speed of growth will be so much faster as i have holding power.

http://photos1.blogger.com/blogger/1689/1183/1600/2006Apr-AsiaPharm-640x333.jpg

GrowMoney QuickPick

Stock: Line of least resistance

Sunray: 0.540

Labroy Marine: 1.52

Zhonguo Powerplus: 0.370

FerrorChina: 0.895

ChinaWheels: 0.440

AsiaEnv: 0.370

AIM: 0.380

UTAC: 0.985

Rotary: 0.595

Ascott: 1.17

Stats: 1.34

SGX: 4.00

Electrotech: 0.590

ChinaSun Bio: 0.735

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, April 02, 2006

Using the 52 weeks high as trading opportunities.

I received some flakes for using a simple method in trading, that is to buy on breaking of 52 weeks high. Some say it will only work in bull market, some say i have no credentials to justify it works. Others hate me for repackaging it as blueline theory because it is a simple method. Although it will be silly of me to try to please all, but i will still explain because I am pretty sure Blueline theory is simple and EFFECTIVE. When I say buy at breaking of the resistance, you do not anyhow buy any stocks that break that high. Daily GrowMoney quickpicks is handpicked by me. I scanned through the charts for those with proper chart base and after volume analysis. Hence it is not a guess work. We are in the bull market since 2003, if resistances were not broken, do you think we can see STI at 2533 ? Did you see how DBS, Capitaland, SIA...etc..recovers from their lows after the 1997 crash and keep breaking resistances to arrive at where they are today? Well I did. Hence that explains that there is nothing wrong in applying blueline theory since we are in a bullish market! What happens if a bear market descends upon us? Then Blueline theory will not work! Price will never break resistance in bearish market hence there will not be any buy signals so how to lose money? Since we notice in a bullish market, prices keep breaking resistance, guess what will happen in bear market? SUPPORT will be broken! That is where you can short ur way down whenever a support is broken. I will be sharing more of this when bear market descends meanwhile, why sit and wait when we can profit from a bullish market? As for credentials, all i can offer is my research work where i share here online for free. I am not a rich old man who has tens years of experience behind me. People who have followed me way back from July'05 should see how i have improved over time. Credentials is earned, i shall just let my quickpick's results do the talking. Lastly, i have packaged this simple method as Blueline theory for the fun factor. Trading is stressful enough and i thought i can provide something different to entertain you abit. Hence you will read funny accronyms from me from time to time. Making money must be fun, otherwise it will be tiring and boring. Now, I still don't understand why there are some who are simply against me from sharing how to profit from a bullish market??? :D May I ask you my dear visitors to show this critics that they are alone? Just post "cheers" in the stock trader's corner....i want to flood out those bearish critics. It will be a spectacular sight! :D

MediaRing for those vested. : ) Swee swee on the weekly chart! Although MediaRing has a new high of 0.365 and it closes at 0.360 on Friday, i do not qualify it in my quickpick list. Simple because it's natural consolidation is before 0.345 and it has broken out! The 0.005 retracement is definitely not a consolidation. You run a risk of babysitting the stock if corrections continue.

GrowMoney QuickPick

Stock: Line of least resistance

Suntec Reits: 1.34 (Reit's shareprice is pegged to the dividend yield. I incuded Suntec to see how it will react to breaking the resistance)

SGX: 4.00

Norelco: 0.450

Hong Fok: 0.590

Zhonguo Powerplus: 0.370

Chinapaper: 0.525

ChinaSun Bio: 0.735

Midas: 0.595

LongCheer: 1.06

ChinaWheels: 0.440

CGTech: 0.420

Sunray: 0.540

Labroy Marine: 1.52

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

MediaRing for those vested. : ) Swee swee on the weekly chart! Although MediaRing has a new high of 0.365 and it closes at 0.360 on Friday, i do not qualify it in my quickpick list. Simple because it's natural consolidation is before 0.345 and it has broken out! The 0.005 retracement is definitely not a consolidation. You run a risk of babysitting the stock if corrections continue.

GrowMoney QuickPick

Stock: Line of least resistance

Suntec Reits: 1.34 (Reit's shareprice is pegged to the dividend yield. I incuded Suntec to see how it will react to breaking the resistance)

SGX: 4.00

Norelco: 0.450

Hong Fok: 0.590

Zhonguo Powerplus: 0.370

Chinapaper: 0.525

ChinaSun Bio: 0.735

Midas: 0.595

LongCheer: 1.06

ChinaWheels: 0.440

CGTech: 0.420

Sunray: 0.540

Labroy Marine: 1.52

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Subscribe to:

Posts (Atom)