K1 Ventur: A failed blueline, i cut my loss for a 0.015 loss. But remember i have Media Ring? The stock to me looks like consolidation going on, but i am not going to wait for it. I said, to cut when a stock breaks blueline and retrace without further upside ought to be cut. I am sticking to my system. Also, i checked and found a shooting star on the weekly chart, history shown that whenever a shooting star is spotted, it always retraces. Furthermore, K1 is a very slow moving stock, i prefer fast moving stock. This is done so that funds can be kept liquid and increase the chance of landing myself into another strong counter that breaks blueline and continues to rally.

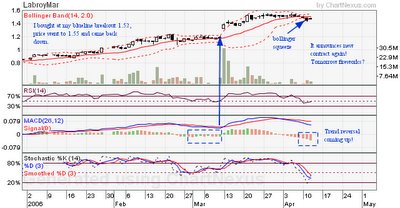

Labroy: When I buy Labroy at blueline breakout, i know i am getting into an oil, gas play. According to my experience, a stock that run up strongly like labroy (from 0.50 to current) must have it's reasons. Remember Hyflux? Cosco? Celestial? Also, recently it transform it's business. Hence i strongly believed it's story is not over yet. I was proven right today when it announces a new contract won! Simple, if it dares to transform it's business, i'm sure they have lots of potential contracts in the pipeline, otherwise why would they risk it? Hence although it failed to clear blueline, retraces, i notice the small volume as compared to history. Hence i hold out. But i was also scared when it was sold down yesterday. But a quick check on the time and sales, looks to me, retailers bailing out. Also my eyes were on indicators...light volume selling and the indicators were heading down ready for a reversal of trend. So my friends, blueline only indicates a scoring chance, you must know your T.A to survive too. Of course, with a new contract it doesn't guarantee a rally tomorrow, but it increases the probability. Let's watch on.

GrowMoney QuickPick

I will buy once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position.

Stock: Line of least resistance

MemTech: 0.340

Hongfuk: 0.65

C&O: 0.495

ChinaWheel: 0.44

ChinaPetro: 0.740

ZhongGuo Power: 0.370

BioTreat: 1.28

China Hongxing: 1.40

ChinaLifestyle: 0.315

AIM: 0.380

HG-Metal: 0.350

Shanghai Turbo: 0.460

YHI: 0.555

AsiaPower: 0.310

ChinaDiary: 0.650

Eelectrotech: 0.655

TiongWoon: 0.335

PacAndes: 0.855

I was right to cast the net further yesterday. Yesterday's list contained lots of breakouts. Charts were saying bullish while i heard and saw conflicting signals on the news. The news somehow influenced me to be bearish. Hence i stuck to my trading systems and today's breakout was a sweet reward. : ) Never decide what will happen. Just make sure you know how to react when the market gets there.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.