STI is at 2383, below the 200MA line. As bearish as it seems, all is not lost. On Tuesday 23rd May I wrote that my past studies shown that 200MA once broken need to close back within days to maintain the uptrend. I was taking reference from Mar'04 and Oct'05. These were the 2 times STI broke the 200MA and came back up within the next 3 days. Time factor is important here. Alot of stocks are very attractive right now and most of them have gapped down. If they are common gaps, it should be closed in the next trading session. Very coincidentally, if they really close up the gaps, STI will also move up it's 200MA. This anticipation of mine allows me to take actions as it is happening. I have missed buying at lows because of FEAR back in Oct'05. Back then, I was not fully prepared. My holdings were negative, I did not look out for signs of reversal and simply just stayed by the sideline. I'm all ready to jump in for a try. If I end up losing, it is a calculated risk rather than a gut feel bet. I prefer to ascertain the market direction before jumping in.

There are 4 types of gaps, common gap, exhaustion gap, breakaway gap and continuation gap. If you are concerned about the gap in your holdings, you may want to do a google on the above terms and learn the characteristics. Our STI has 3 gaps on the daily each with different volume. This is clue to where we are heading in the next couple of days.

Welcome to my trading journal! A place where I share my Psychology, Money Management & Trading system on trading shares in the Singapore Stock Market. Fellow shares enthusiasts are welcomed to share thoughts too. I hope my posts will be educational to you in your quest to growmoney. I can be reached at eehwa.ng@gmail.com outside of the blog.

Wednesday, May 31, 2006

Monday, May 29, 2006

Stocks drifted lower as suspicions of a bottom surfaced.

Another mixed day. Stock market is cautiously basing out a bottom. Bulls are not buying enthusiastically and bears dare not sell aggressively. A quick check on volume shows that today's volume has dipped and most stocks traded under average volume. I remember when the index is bottoming, individual stocks will start to reverse. I will continue to keep a close watch for positive development.

1 sector i noticed has limited selling. Harddisk. But overall, the weekly charts look bad. Although I think a bottom is basing out, but i shall not start to buy because that is just my gut feel. I must see the characteristics of a bottom before I can start to buy.

GrowMoney QuickPick

"Silas" made a very good point in a debate with me today. My homework posted online will do more harm than good if the reader do not do due diligence and buy blindly. As such, I must repeat. This section of the blog are stocks that I am interested in. You should perform your own analysis before buying. Always know what you are getting yourself into rather than doing it blindly.

ASL Marine, volume broke 50ma of volume, but because it's below 200MA, it's wiser to see what it is up to. 61.8% Fibbo retracement at 0.605.

AsiaPower, it's defiance to the sell down looks interesting. Historical high is pegged at 0.370.

KepT&T, 3 yrs high pegged at 1.63

Tiongwoon, sitting on support 0.250. But stock price has declined below 200MA on the daily chart. If stock rebound above 200Ma from here, Good! Otherwise...the low gets lower.

Those who have signed up for the workshop tomorrow, See you at 7pm! : )

1 sector i noticed has limited selling. Harddisk. But overall, the weekly charts look bad. Although I think a bottom is basing out, but i shall not start to buy because that is just my gut feel. I must see the characteristics of a bottom before I can start to buy.

GrowMoney QuickPick

"Silas" made a very good point in a debate with me today. My homework posted online will do more harm than good if the reader do not do due diligence and buy blindly. As such, I must repeat. This section of the blog are stocks that I am interested in. You should perform your own analysis before buying. Always know what you are getting yourself into rather than doing it blindly.

ASL Marine, volume broke 50ma of volume, but because it's below 200MA, it's wiser to see what it is up to. 61.8% Fibbo retracement at 0.605.

AsiaPower, it's defiance to the sell down looks interesting. Historical high is pegged at 0.370.

KepT&T, 3 yrs high pegged at 1.63

Tiongwoon, sitting on support 0.250. But stock price has declined below 200MA on the daily chart. If stock rebound above 200Ma from here, Good! Otherwise...the low gets lower.

Those who have signed up for the workshop tomorrow, See you at 7pm! : )

Sunday, May 28, 2006

Casino Shocker!

After scanning through the market, i saw quite a number of index stocks with gaps existing and we are going to test that resistance. It augers well if we are able to close the gap. Also, plenty of stocks trading near support. It showed that there are still bargain hunters scooping in for them. STI's 200 MA at 2400 there abouts has been tested a couple of time. Each time we saw buyers swamp in to buy. Good sign. If market hold around 2400, I will start to collect stocks slowly throughout June...keke My eyes are on all the gaps in the index as well as some stocks. If they show signs of exhaustion gap, time to load up my dear friends. But if it shows breakaway gap, time to short! :D

Federal: Checked out the weekly chart over weekend. It's decline is more than the indices however the volume is low. Please do not think low volume is always good. Low and steady volume means selling in constant! When that happens, the down trend continues. All you need to do is look at the low volume Mar'04. Heart Wrenching. I had thought 50 cts to hold as support but that gives way last week.

What a surprise! Both Capitaland and Keppel Land had lost the IR bid! Both will be severely punished on Monday. Those who like to play intra day tomorrow, here's your chance! :D

Federal: Checked out the weekly chart over weekend. It's decline is more than the indices however the volume is low. Please do not think low volume is always good. Low and steady volume means selling in constant! When that happens, the down trend continues. All you need to do is look at the low volume Mar'04. Heart Wrenching. I had thought 50 cts to hold as support but that gives way last week.

What a surprise! Both Capitaland and Keppel Land had lost the IR bid! Both will be severely punished on Monday. Those who like to play intra day tomorrow, here's your chance! :D

Thursday, May 25, 2006

Great Singapore Sale now on even in Stock Market!

Yesterday I introduced a wonder stock to you. Despite a bad day, it showed true to it's pattern! Profitable pattern hor. A pity i am not able to trade it because i am not around whole day. Those who have the whole day to themselves might wanna take a look.

Well well...market melt again. But this time round it's desirable. Why? Because it tested the 200MA and rebounded off. Recalling my post earlier this week, i mentioned that it will hug the 200MA like a lover. It maybe shorts covering but that is everybody's guess. I am now looking at many stocks right at support level with attractive risk/reward. Throughout my experience, there are only 2 wise time to buy a stock, either at/near support or breaking of resistance. Now that many stocks are at support, stocks of value by the sector and growth potential should be good. Well, as long as 200MA is not broken. Now that it is retested, i anticipate firmer actions that will define the much needed base.

We had a gap down last Monday on STI and if heavy volume doesn't show lower low, it shows the bears are out of strength. Even if we talk about FA, global growth still intact, let's just see what unfolds.

Well well...market melt again. But this time round it's desirable. Why? Because it tested the 200MA and rebounded off. Recalling my post earlier this week, i mentioned that it will hug the 200MA like a lover. It maybe shorts covering but that is everybody's guess. I am now looking at many stocks right at support level with attractive risk/reward. Throughout my experience, there are only 2 wise time to buy a stock, either at/near support or breaking of resistance. Now that many stocks are at support, stocks of value by the sector and growth potential should be good. Well, as long as 200MA is not broken. Now that it is retested, i anticipate firmer actions that will define the much needed base.

We had a gap down last Monday on STI and if heavy volume doesn't show lower low, it shows the bears are out of strength. Even if we talk about FA, global growth still intact, let's just see what unfolds.

Wednesday, May 24, 2006

Stock Market Cha Cha Cha

Enough of comments on my anticipation. Tonight it's all about good risk/reward picks! Enjoy!

My anticipation of the stock market remains. 2 more weeks to World Cup where girl friends and wives suddenly lost their husbands and boyfriends to the TV. haha!

Stock Market should continue to drift or even slide lower but the slide must be on lower volume. My reasons were, after heavy selling since Monday, market started drifting. This forces the bears to think twice about shorting as the risk reward is not fantastic. But at the same time, bulls are not willing to buy any higher from support level. What I would like to see is continued buying at support levels to define a base. If we are successful in avioding the relegation, 2800 here we come!

For those interested to learn about how I use Chartnexus to derive quickpicks, you are welcomed to join me here, http://www.chartnexus.com/company/presscontent.php?pid=270

Check this out man! Another reason for you to stick around my blog daily. You never know what I can dig out from the stock market!*grin*

News Flash

Significant insider buying in Midas, Honguo, UTAC

LABROY MARINE LIMITED SECURES SHIPBUILDING CONTRACTS WORTH US$28,800,000

GrowMoney QuickPick

KepT&T - watching the 1.63 level

AsiaPower - watching for breakout

UOL - watching for breakout

Stocks that were in oversold and price near support, very attractive risk/reward!

AsiaEnv

ChinaFish

ChinaWheel

Ellipsiz

Fibrechem

FungChoi

Hongguo

KeppelCorp

M1

Media Ring

MFS

People's Food

SembCorp

SuperCoffee

TiongWoon

UTAC

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

My anticipation of the stock market remains. 2 more weeks to World Cup where girl friends and wives suddenly lost their husbands and boyfriends to the TV. haha!

Stock Market should continue to drift or even slide lower but the slide must be on lower volume. My reasons were, after heavy selling since Monday, market started drifting. This forces the bears to think twice about shorting as the risk reward is not fantastic. But at the same time, bulls are not willing to buy any higher from support level. What I would like to see is continued buying at support levels to define a base. If we are successful in avioding the relegation, 2800 here we come!

For those interested to learn about how I use Chartnexus to derive quickpicks, you are welcomed to join me here, http://www.chartnexus.com/company/presscontent.php?pid=270

Check this out man! Another reason for you to stick around my blog daily. You never know what I can dig out from the stock market!*grin*

News Flash

Significant insider buying in Midas, Honguo, UTAC

LABROY MARINE LIMITED SECURES SHIPBUILDING CONTRACTS WORTH US$28,800,000

GrowMoney QuickPick

KepT&T - watching the 1.63 level

AsiaPower - watching for breakout

UOL - watching for breakout

Stocks that were in oversold and price near support, very attractive risk/reward!

AsiaEnv

ChinaFish

ChinaWheel

Ellipsiz

Fibrechem

FungChoi

Hongguo

KeppelCorp

M1

Media Ring

MFS

People's Food

SembCorp

SuperCoffee

TiongWoon

UTAC

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tuesday, May 23, 2006

Stock Market Rebounded But Only Just

A very rocky day as we tested 200 MA and now resting slightly above it. My next anticipation is for another leg down to test or even break it on a lesser volume and Technical indicators showing divergence. This will complete a nice bottom and get ready to reverse back to the uptrend. But this is just my anticipation. Market fallen so fast and hard, it will take some time for it to recover. Let's watch on.

Today lots of stocks rebounded with volume. Seems to me some of the China plays are still in demand as bargain hunters picked them up today. However I do not rule out another test to the lows.

Somehow, time seems to be on the bulls side. June seems like a good time to form base for a rally in July due to the results season. Hence, for better risk/reward I will pick up stocks during World Cup instead. Otherwise I may end up losing unnecessarily.

GrowMoney QuickPick

Some of the stocks which I think looked interesting.

HongGuo

Keppel Land

PacAndes

Capital Land

Federal

Rotary

MediaRing

Today lots of stocks rebounded with volume. Seems to me some of the China plays are still in demand as bargain hunters picked them up today. However I do not rule out another test to the lows.

Somehow, time seems to be on the bulls side. June seems like a good time to form base for a rally in July due to the results season. Hence, for better risk/reward I will pick up stocks during World Cup instead. Otherwise I may end up losing unnecessarily.

GrowMoney QuickPick

Some of the stocks which I think looked interesting.

HongGuo

Keppel Land

PacAndes

Capital Land

Federal

Rotary

MediaRing

Monday, May 22, 2006

Stock Index to Test 200 MA at 2393

Market was massacred today. We have now broken 50 days & 100 days moving average and the next important level of support will be at 2393 which is the 200 moving average (MA). This support is the strongest and should not be breached easily. Please refer to my chart on how we fare on 2 recent occassions where 200 MA was seriously threatened.

Recalling all the signs of this massacre, although I must admit I did not anticipate such a fierce selling. The signs were, banks started to move, this was related to me by an experienced trader, he warned to watch out if banks start to move. You may find the records on May 1st article. The next sign was Elections. I have studied and noted that market will retrace and even corrects for the first 2 years after elections. Never thought it came so fast and furious. The third sign was no good chart patterns found, most are extended very far and the risk was very high. What I did correct this time round as compared to last year was trimming down my stocks as elections approaches and taking my profits post elections.

Alright, no picks for tonight, let's watch how the market unfolds as it is near it's 200 MA.

STI Chart, Click to open the chart. As we near the 200 MA, as soon as we successfully tested it and market is trading closely to the 200MA, I will start to buy small. I take reference from previous experience when market touches 200MA and then rallies off it to new highs.

P.S Xiao di me aka Decipher upon invitation of Chartnexus will be presenting to you how I use Chartnexus and XpertTrader module to scan the market for Quickpicks. For more details, you can click the banner right on the top which says, "Maximising Through Technological Advantage". : ) The objective is to see you walk out of the training knowing how to use XpertTrader to find your own QuickPicks! :D

Recalling all the signs of this massacre, although I must admit I did not anticipate such a fierce selling. The signs were, banks started to move, this was related to me by an experienced trader, he warned to watch out if banks start to move. You may find the records on May 1st article. The next sign was Elections. I have studied and noted that market will retrace and even corrects for the first 2 years after elections. Never thought it came so fast and furious. The third sign was no good chart patterns found, most are extended very far and the risk was very high. What I did correct this time round as compared to last year was trimming down my stocks as elections approaches and taking my profits post elections.

Alright, no picks for tonight, let's watch how the market unfolds as it is near it's 200 MA.

STI Chart, Click to open the chart. As we near the 200 MA, as soon as we successfully tested it and market is trading closely to the 200MA, I will start to buy small. I take reference from previous experience when market touches 200MA and then rallies off it to new highs.

P.S Xiao di me aka Decipher upon invitation of Chartnexus will be presenting to you how I use Chartnexus and XpertTrader module to scan the market for Quickpicks. For more details, you can click the banner right on the top which says, "Maximising Through Technological Advantage". : ) The objective is to see you walk out of the training knowing how to use XpertTrader to find your own QuickPicks! :D

Sunday, May 21, 2006

Stock Indices Down, Confidence Up!

Refering to my past articles from Oct'05 to Dec'05, I noted that I was pretty slow in catching reversals. This time round, i'm determined not to let this good chance slip away. After such a serious and heavy selling in equities and commodities, is the economy finally going to give way? A quick check on indices' chart revealed that we are still not in danger yet. After such a bad fall, we need a few mix weeks to form a base for another leg up. Remember what I said about market after Elections and the World Cup? Isn't World cup a good time for the base to form since the market is almost going to be quiet for sure. While you are watching the world class football on your Plasma, do not forget to track your favourite stocks, the best is to buy near or at support. I know everyone has taken some losses here and there, but hey! This is part of trading. You can lose money but never lose your confidence!

During my daily sentiment scan, i noted many stocks were deeply oversold. Golden chance and very good risk/reward! :D Although I'm anticipating bottoms, but I will prefer to let it comfirms before I place a trade.

For those who are interested in Astrology Analysis, 20 May 2006 is a MAJOR bradley turn date. The market trend will reverse according to theory.

The wise saying goes like this....."When no one is buying, you buy! When everyone is buying, you sell to them!"

GrowMoney QuickPick

I will be adopting swing trading for now.

ChinaPetro

Chartered

UTAC

Federal

Rotary

Keppel Corp

During my daily sentiment scan, i noted many stocks were deeply oversold. Golden chance and very good risk/reward! :D Although I'm anticipating bottoms, but I will prefer to let it comfirms before I place a trade.

For those who are interested in Astrology Analysis, 20 May 2006 is a MAJOR bradley turn date. The market trend will reverse according to theory.

The wise saying goes like this....."When no one is buying, you buy! When everyone is buying, you sell to them!"

GrowMoney QuickPick

I will be adopting swing trading for now.

ChinaPetro

Chartered

UTAC

Federal

Rotary

Keppel Corp

Wednesday, May 17, 2006

Market Index with a big Gap

I saw a big gap in STI from 2618 to 2581. They say gaps will be covered. The psychology behind gaps was there are stuck traders in that range and price will test and cover the gap.Also, the gap could have exhausted the selling. When selling dries up, buying will occur. For market reversal pattern, we are still in the early stage, watch the possible formationof double top or head and shoulder. That will be when you should open a shares borrowing accountlike CFD or SBL account to trade the downside.

If market really reverses and turns bearish, those people who bought funds recently will cry. I had heard so many people rejoicing how well their funds had performed. But they didn't realise funds are highly related to equities and by buying in recent times, they are buying at highs. Anyway, there are still many people out of the market hence no la, big reversal not yet. Let's watch on.

I would be looking at the following stocks for signs of reversal.

GrowMoney QuickPick

MediaRing

Federal

China Essence

DataCraft

LMA

If market really reverses and turns bearish, those people who bought funds recently will cry. I had heard so many people rejoicing how well their funds had performed. But they didn't realise funds are highly related to equities and by buying in recent times, they are buying at highs. Anyway, there are still many people out of the market hence no la, big reversal not yet. Let's watch on.

I would be looking at the following stocks for signs of reversal.

GrowMoney QuickPick

MediaRing

Federal

China Essence

DataCraft

LMA

Monday, May 15, 2006

Spotting Rebound Gems in a Beaten Stock Market

What a sell off and I thought we had Vesak day saving us from an unavoidable bear paw. The last time something like this happened was in Oct'05. I was caught with my pants down. Profits were wiped out and losses taken. Then I tried to play the catch the rebound game. Guess what? Market went down 3 consecutive days and tested the 200MA which many regarded as the major trend line.

Those who had taken losses will feel the pain and not look at the market for a while. WRONG MOVE! This is exactly the time you should be watching! The next few sessions will offer excellent opportunities! Watch the rebound of the market and go in for the kill! The next few sessions can also determine if we will break the long term trendline.

I am just glad this time round i am quick enough to liquidate my holdings after the elections. I did my homework and followed my plan accordingly daily and this time round market had failed to pull my pants down! keke

I will sound the honk if I think the great reversal is here.

GrowMoney QuickPick

I will be watching out for the stocks listed below for Candlesticks Reversal before getting vested.

ChinaPetro

CAO

Federal

FungChoi

Hongguo

Sky Petrol

TiongWoon

SuperCoffee

TechOilGas

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Those who had taken losses will feel the pain and not look at the market for a while. WRONG MOVE! This is exactly the time you should be watching! The next few sessions will offer excellent opportunities! Watch the rebound of the market and go in for the kill! The next few sessions can also determine if we will break the long term trendline.

I am just glad this time round i am quick enough to liquidate my holdings after the elections. I did my homework and followed my plan accordingly daily and this time round market had failed to pull my pants down! keke

I will sound the honk if I think the great reversal is here.

GrowMoney QuickPick

I will be watching out for the stocks listed below for Candlesticks Reversal before getting vested.

ChinaPetro

CAO

Federal

FungChoi

Hongguo

Sky Petrol

TiongWoon

SuperCoffee

TechOilGas

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, May 14, 2006

No eyes to see Stock Market tomorrow

Isn't my title interesting! haha With US and global markets facing a sell off, what chance do our little Singapore Bourse has to defy the order? If you don't want to spoil your mood on a Monday, do not see the market at the opening bell. That's the best way to avoid selling because of fear. For me, i will be examining the damage and make my decision based on what had happened and not by anticipating what will happen.

In all dead seriousness, I analysed Dow & Nasdaq charts. The sell off was with volume and I have not seen an end yet. While many like to predict a technical rebound on Monday, I prefer to stay aside and let market form a bottom before I get vested again. My rule is, when I buy, i want to make sure the major trend is working for me. Currently there is too much uncertainty.

Complacency is the downfall of many. How did many people get caught in the 2000 bear market? The recent strong rebound of China Stocks reminded me of that. It will cause many people to kick dirt and exclaim "Shouldn't have cut lost! My stocks rebounded!" The next time their ChinaStocks retraces, they are not going to sell because they "think" it will rebound! This is exactly what happened in 2000 where many thought it was normaly retracement because they seen how fast and furious tech stocks rebounded. In fact some of them bought on the way down. Imagine owning Chartered at $10, $8 then $5. OUCH!

Remember what I said after Elections? Isn't it uncanny that why after elections there will be big sell offs? Now, who says history doesn't repeat itself? keke Now, let's see if history repeats itself at the World Cup. :D

Patiently awaiting the golden opportunity.

In all dead seriousness, I analysed Dow & Nasdaq charts. The sell off was with volume and I have not seen an end yet. While many like to predict a technical rebound on Monday, I prefer to stay aside and let market form a bottom before I get vested again. My rule is, when I buy, i want to make sure the major trend is working for me. Currently there is too much uncertainty.

Complacency is the downfall of many. How did many people get caught in the 2000 bear market? The recent strong rebound of China Stocks reminded me of that. It will cause many people to kick dirt and exclaim "Shouldn't have cut lost! My stocks rebounded!" The next time their ChinaStocks retraces, they are not going to sell because they "think" it will rebound! This is exactly what happened in 2000 where many thought it was normaly retracement because they seen how fast and furious tech stocks rebounded. In fact some of them bought on the way down. Imagine owning Chartered at $10, $8 then $5. OUCH!

Remember what I said after Elections? Isn't it uncanny that why after elections there will be big sell offs? Now, who says history doesn't repeat itself? keke Now, let's see if history repeats itself at the World Cup. :D

Patiently awaiting the golden opportunity.

Wednesday, May 10, 2006

Stock Market Staged a Counter Attack!

The day began slow and uncertain. However after mid day, the red army staged a counter attack and many of them topped the Most Active stocks list. By closing, STI went up 13 points! Wow...long time no use this phrase, expect the unexpected!

However since tomorrow is the last trading day of the week, there could be profit taking. Simple, those who were squeezed or had cut loss, will still be remembering their pain and hence there is little chance they will hold over the long weekend. Infact, most of them will exit at their buy price due to the fear.

No blueline but i included a list of interesting stocks for your perusal. Given a long weekend ahead, it is not a good time to use blueline theory for now.

GrowMoney Quickpick

Charted

BeautyChina

Ausgrp

ChinaSun

TiongWoon

UTAC

However since tomorrow is the last trading day of the week, there could be profit taking. Simple, those who were squeezed or had cut loss, will still be remembering their pain and hence there is little chance they will hold over the long weekend. Infact, most of them will exit at their buy price due to the fear.

No blueline but i included a list of interesting stocks for your perusal. Given a long weekend ahead, it is not a good time to use blueline theory for now.

GrowMoney Quickpick

Charted

BeautyChina

Ausgrp

ChinaSun

TiongWoon

UTAC

Monday, May 08, 2006

Stock Market did the Elections rally

Just like the Kallang waves of the Malaysia cup heydays, what a beautiful day for the STI components. With investors' all time heavyweights making the best gains. Especially GLCs. I saw casino plays as being the most obvious while the rest are just up in tantem. Broadbase market are still weak. The inability to close at day's high is not convincing to me.

Semb Marine is up but i see hesistation in Cosco and Labroy Marine. Jaya Holdings reported a good set of results. This further add strength to my analysis that ship repairing sector should be watched.

Oil and Gas plays slept during the day once again. There were little volume in them for the longest time. When heavy volume comes in, they rallied up instead of down. I will continue to monitor this sector. Oil price has now dropped below US$70 per barrel. This should encourage the market to further test historical high. No doubt oil price may have simmered but i'm sure activities related to oil industry are still on going because the demand and supply are still very tight. If activities slow down, demand will definitely drives prices up and this is the last thing OPEC and rest of the world wants.

Chips were not in the mood for party today as well. Looks like some sort of profit taking in them. Volume traded were light while price holds steady. They were always volatile.

Bio medical companies also saw profit taking. The likes of AsiaPharm offers great opportunity. Templeton fund is an international reknown fund house and when they took up AsiaPharm's shares, definitely they saw something which they liked. Remember Celestial? If you have such a strong fund house supporting, it's worth to get invested as well. It will be best to use T.A to time your entry.

Semb Marine is up but i see hesistation in Cosco and Labroy Marine. Jaya Holdings reported a good set of results. This further add strength to my analysis that ship repairing sector should be watched.

Oil and Gas plays slept during the day once again. There were little volume in them for the longest time. When heavy volume comes in, they rallied up instead of down. I will continue to monitor this sector. Oil price has now dropped below US$70 per barrel. This should encourage the market to further test historical high. No doubt oil price may have simmered but i'm sure activities related to oil industry are still on going because the demand and supply are still very tight. If activities slow down, demand will definitely drives prices up and this is the last thing OPEC and rest of the world wants.

Chips were not in the mood for party today as well. Looks like some sort of profit taking in them. Volume traded were light while price holds steady. They were always volatile.

Bio medical companies also saw profit taking. The likes of AsiaPharm offers great opportunity. Templeton fund is an international reknown fund house and when they took up AsiaPharm's shares, definitely they saw something which they liked. Remember Celestial? If you have such a strong fund house supporting, it's worth to get invested as well. It will be best to use T.A to time your entry.

Sunday, May 07, 2006

Stock Market After The Elections

PAP secured a 66% mandate and reports were saying it is a great showing. Heng arh, they didn't shot down the results because it can be seen that opposition has garnered more votes than 2001. Except for SDP, if they didn't bother to contest Sembawang, I think PAP will not have gotten 66% simply because the margin of defeat by SDP is too huge.

Dow rallied on Friday on hopes of interest rate hikes pause. PAP won 82 seats out of 84. These 2 elements should prove to be fuel to a rally tomorrow. On Friday we had seen market trading on the downside bias because most people fear the uncertainty of the elections results.

Legends always say, do not anticipate the market movement because opinions may not be right but market is always right. Learn to understand what had happened and what is happening now. For me, i am seeing property sector retracing, oil & gas showing some sparkle, banks had rallied. Marine repair seems to be enjoying good business with Cosco Corp & Labroy Marine turning in good results.

I did scan the market and found nothing interesting to risk our dollars in. So what I did was rearranged my watchlist into sectors! This way, i can track the leaders of each sector closely. No more wild punting! :D

Well, market may or may not rally tomorrow. But one thing is for sure, i still don't see a big bear descending and will not sell my holdings as yet. Hence I'm going to enjoy my holiday tomorrow! Shall not be online. I hope you guys tua tua tan and enjoy shouting at the shoutbox! But while doing so, don't forget to wriggle your index finger no matter which hand! :D Shall analyse the post elections market on Monday instead.

Dow rallied on Friday on hopes of interest rate hikes pause. PAP won 82 seats out of 84. These 2 elements should prove to be fuel to a rally tomorrow. On Friday we had seen market trading on the downside bias because most people fear the uncertainty of the elections results.

Legends always say, do not anticipate the market movement because opinions may not be right but market is always right. Learn to understand what had happened and what is happening now. For me, i am seeing property sector retracing, oil & gas showing some sparkle, banks had rallied. Marine repair seems to be enjoying good business with Cosco Corp & Labroy Marine turning in good results.

I did scan the market and found nothing interesting to risk our dollars in. So what I did was rearranged my watchlist into sectors! This way, i can track the leaders of each sector closely. No more wild punting! :D

Well, market may or may not rally tomorrow. But one thing is for sure, i still don't see a big bear descending and will not sell my holdings as yet. Hence I'm going to enjoy my holiday tomorrow! Shall not be online. I hope you guys tua tua tan and enjoy shouting at the shoutbox! But while doing so, don't forget to wriggle your index finger no matter which hand! :D Shall analyse the post elections market on Monday instead.

Thursday, May 04, 2006

Stock Market sashays down on profit taking

Livermore and O'Neil both mentioned that we must look at the broader picture and if you get the market direction wrong, you will lose money in 3 out of 4 stocks. With 2 good days of follow through buying, market took a breather today.

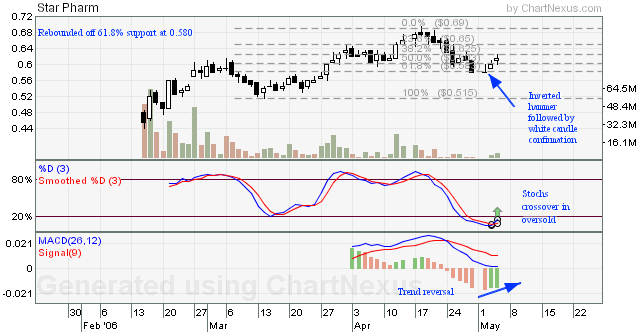

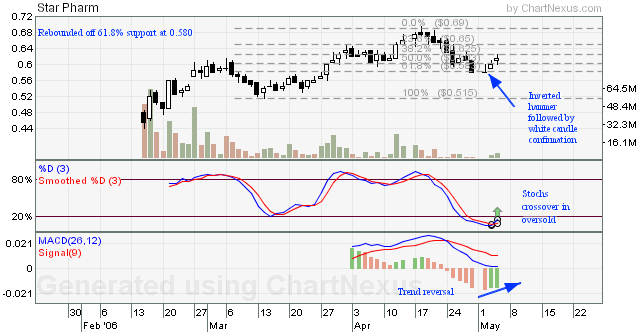

Tonight i'm showing you 3 stocks belonging to pharma sector. Woo..all 3 showing similar reversal patterns. Except for AsiaPharm which is doing placement so might affect the trading tomorrow.

As for oil and gas plays, i'm not so confident about them yet. Although Labroy and Rotary keeping everyone happy for now! :D Psst psst remember i keep saying my fingers are oily last few weeks??? keke

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tonight i'm showing you 3 stocks belonging to pharma sector. Woo..all 3 showing similar reversal patterns. Except for AsiaPharm which is doing placement so might affect the trading tomorrow.

As for oil and gas plays, i'm not so confident about them yet. Although Labroy and Rotary keeping everyone happy for now! :D Psst psst remember i keep saying my fingers are oily last few weeks??? keke

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Wednesday, May 03, 2006

Stock Market is at historical high again!

My research of pre elections rally proves itself. This is the prelude to a correction after Elections since my research also showed that the past 2 elections always result in a market corrections thereafter. It's insane to see market hit 20 pointers gain for 2 consecutive days. Some China plays are back into the limelight...chinasun, chinapetro... This tells me one thing...only the leaders of a play will rebound strongest! For laggards, it is not the best of interest to hold on and hope. That's why I cut my ChinaWheel. All along it is never a leader in China rallys. Banks are in the lead today. The wise man said,"if laggards like banks start to move, it's time to get out and watch." I will observe and get out at the slightest bearish hints.

My sincere apologies to brokers. I have since removed the passage from my article. My intention was to entice visitors to "reward" me at my blog however i have also unwittingly discredited brokers. It must be the elections updates on the TV distracting me and I end up insinuating brokers just like the election rallies. keke Sorry! Next time I will watch what I say. : )

GrowMoney QuickPick

Stock: Line of Least Resistance

AsiaPower: 0.370

Biosensor: 1.31

Celestial: 1.64

Chartered: 1.87

ChinaFish: 3.56

Cosco: 1.48

GlobalTest: 0.370

SuperCoffee: 0.620

UTAC: 1.10

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

My sincere apologies to brokers. I have since removed the passage from my article. My intention was to entice visitors to "reward" me at my blog however i have also unwittingly discredited brokers. It must be the elections updates on the TV distracting me and I end up insinuating brokers just like the election rallies. keke Sorry! Next time I will watch what I say. : )

GrowMoney QuickPick

Stock: Line of Least Resistance

AsiaPower: 0.370

Biosensor: 1.31

Celestial: 1.64

Chartered: 1.87

ChinaFish: 3.56

Cosco: 1.48

GlobalTest: 0.370

SuperCoffee: 0.620

UTAC: 1.10

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tuesday, May 02, 2006

Stock Market up on Elections

The first part of my anticipation is correct. Market indeed is up because of elections. However, many people are still trapped in the penny shares. Broadbase sentiment is not as brilliant as STI. Even I had to cut one of stocks today. Read about why i cut ChinaWheel below. With less than a week before Elections, i will be paring down my stocks for i fear market reaction after elections. Let's not forget, it is a short week next week too.

Losses I cut, but donations i will still contribute. As long as i have some pocket money from running this blog, i will continue with my pledged 15% to my adopted charity.

Quickpick list is back!

GrowMoney QuickPick

Stock: Line of Least Resistance

AsiaPower: 0.370

Biosensor: 1.31

Chartered: 1.87

ChinaFish: 3.56

Cosco: 1.48

DataCraft: 1.22

GlobalTest: 0.370

KeppelTT: 1.59

Midas: 0.940

SembMar: 3.18

Sinopipe: 0.425

SuperCoffee: 0.620

Youcan: 0.335

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Losses I cut, but donations i will still contribute. As long as i have some pocket money from running this blog, i will continue with my pledged 15% to my adopted charity.

Quickpick list is back!

GrowMoney QuickPick

Stock: Line of Least Resistance

AsiaPower: 0.370

Biosensor: 1.31

Chartered: 1.87

ChinaFish: 3.56

Cosco: 1.48

DataCraft: 1.22

GlobalTest: 0.370

KeppelTT: 1.59

Midas: 0.940

SembMar: 3.18

Sinopipe: 0.425

SuperCoffee: 0.620

Youcan: 0.335

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Trade the market & do Charity

Here is my favourite moment of the month!

I will be donating 15% of any revenue generated from GrowMoney blog to my adopted charity every month.

I made my donation to Children's Cancer Foundation today. Although my donations are small, but i sincerely hope it will at least help in a small way.

Thank you for making this possible. : )

Donation was made via http://www.donation.org.sg/ . A really convenient way : )

4D hot number from the donations. keke

1075

Huat ah!

I will be donating 15% of any revenue generated from GrowMoney blog to my adopted charity every month.

I made my donation to Children's Cancer Foundation today. Although my donations are small, but i sincerely hope it will at least help in a small way.

Thank you for making this possible. : )

Donation was made via http://www.donation.org.sg/ . A really convenient way : )

4D hot number from the donations. keke

1075

Huat ah!

Monday, May 01, 2006

Stock Market Analysis draws a blank

No matter which filters i scan the market with, it seems to me a broad market retracement in progress. Notably, China Plays have been hacked down. Semi Con industry looks hesistant. Property looks set to correct after a massive run up. Oil and Gas plays fail to shine despite higher oil prices. I could not find a good risk reward stock to post tonight. To me, i'm unclear, i prefer to stay clear of the market. It's not easy because I have to contain the greed and not to take risky position. I reminded myself there will always be another opportunity in the market. It is highly important that i should continue to observe how our market develops from here. Because, not only will it adds on to my experience, i won't miss any chance of a re-entry! The rebound rally of the market is important this week. Let's see the strength of the rebound.

Elections is just a week away. Looking at historical pattern, market will be cheering before the judgement day. However i did notice a difference. In 1997 and 2001, PAP return to power on Election day and this time round, the margin of victory will be scrutinised by market. In a nutshell, if PAP did not win by a very comfortable margin, a sell off in the market can be expected.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Elections is just a week away. Looking at historical pattern, market will be cheering before the judgement day. However i did notice a difference. In 1997 and 2001, PAP return to power on Election day and this time round, the margin of victory will be scrutinised by market. In a nutshell, if PAP did not win by a very comfortable margin, a sell off in the market can be expected.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Subscribe to:

Posts (Atom)