Did you guys notice the list getting longer? I think market heading for consolidation soon. It's a good thing, because we need that...otherwise the rally is unsustainable. If the market goes into a few weeks consolidation, we will all have a chance to hold on to the next celestial or ferror china! Don't like Cheena stocks? How about Keppel Land, Capital Land? City Dev maybe? They all rally after consolidations.

Quickpick list continues to outperform the market. Every other day some of the stocks mentioned will be profitable. Hence if you miss, do not fret....just wait for next day! :D

Growmoney Quickpick

Stock: Line of least resistance

SMRT: 1.16

Labroy: 1.52

Contel: 0.440

China Diary: 0.490

ChinaWheel: 0.440

CGTech:0.420

Sinomem: 0.940

Memory D: 0.520

Hong Guo: 0.500

Sunray: 0.540

Midas: 0.585

C&O: 0.485

MFS: 1.22

K1: 0.430

I wouldn't put REITS in the list because they are dividend plays. As the price goes higher, the dividend yield gets lower. Well unless they are acquisiting.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Welcome to my trading journal! A place where I share my Psychology, Money Management & Trading system on trading shares in the Singapore Stock Market. Fellow shares enthusiasts are welcomed to share thoughts too. I hope my posts will be educational to you in your quest to growmoney. I can be reached at eehwa.ng@gmail.com outside of the blog.

Thursday, March 30, 2006

Wednesday, March 29, 2006

Trading the blueline in stock market.

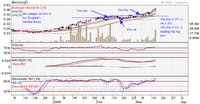

If you think i'm lucky with my blueline theory and my technical analysis is mediocre, look here http://photos1.blogger.com/blogger/1689/1183/1600/2006Apr-MediaRing-640x332.jpg .

This was what I saw Media Ring coming. It is important to be able to be in groove with the stock you are analysing. Some form of anticipation must be made and if the stock acts according to your anticipation, you will benefit. All the rules of how I learn this ability are documented in the charts. If you are interested, you may want to read from the November'05 Archives. There are differences between a healthy and normal retracement versus a bearish one. Read all about it from the Archives. It's free! However if reading is not your cup of tea, if you have kids at home that need your attention, you have a wife or husband that want you to sayang them after office hour, i am stepping out of cyber space to meet and teach soon. Just watch for the announcement. : )

It is human to buy at a cheaper price, they feel comforted if they buy at a discount. But in speculating, i realised the high goes higher. The expensive becomes more expensive. Don't take my words for it. Take a look at the charts. Aren't stocks always move to new high in explosive fashion? Now, if I am a speculator, isn't this a very profitable strategy? Every resistance will be broken one day, it is our job to detect when and how to capitalise! This is what blueline theory is all about. It is a simple yet effective strategy. If we are in a bear market, you can be sure there will either be many false breaks of resistance or there weren't any at all! So that is when we should look the other way, redline theory. Where the low goes lower.

GrowMoney Quickpick

Stock: Line of Least Resistance

Tat Hong: 0.890

Labroy: 1.52

SGX: 4.00

MediaRing: 0.345

KS Engery: 3.00

HongKong Land: 3.80

Chartered: 1.48

Sunray: 0.540

Midas: 0.585

Inter roller: 1.98

China Diary: 0.490

Hong Guo: 0.500

ChinaWheel: 0.440

CGTech:0.420

C&O: 0.485

*If you do not know how to use this list profitably, be sure to read the past postings.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

This was what I saw Media Ring coming. It is important to be able to be in groove with the stock you are analysing. Some form of anticipation must be made and if the stock acts according to your anticipation, you will benefit. All the rules of how I learn this ability are documented in the charts. If you are interested, you may want to read from the November'05 Archives. There are differences between a healthy and normal retracement versus a bearish one. Read all about it from the Archives. It's free! However if reading is not your cup of tea, if you have kids at home that need your attention, you have a wife or husband that want you to sayang them after office hour, i am stepping out of cyber space to meet and teach soon. Just watch for the announcement. : )

It is human to buy at a cheaper price, they feel comforted if they buy at a discount. But in speculating, i realised the high goes higher. The expensive becomes more expensive. Don't take my words for it. Take a look at the charts. Aren't stocks always move to new high in explosive fashion? Now, if I am a speculator, isn't this a very profitable strategy? Every resistance will be broken one day, it is our job to detect when and how to capitalise! This is what blueline theory is all about. It is a simple yet effective strategy. If we are in a bear market, you can be sure there will either be many false breaks of resistance or there weren't any at all! So that is when we should look the other way, redline theory. Where the low goes lower.

GrowMoney Quickpick

Stock: Line of Least Resistance

Tat Hong: 0.890

Labroy: 1.52

SGX: 4.00

MediaRing: 0.345

KS Engery: 3.00

HongKong Land: 3.80

Chartered: 1.48

Sunray: 0.540

Midas: 0.585

Inter roller: 1.98

China Diary: 0.490

Hong Guo: 0.500

ChinaWheel: 0.440

CGTech:0.420

C&O: 0.485

*If you do not know how to use this list profitably, be sure to read the past postings.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tuesday, March 28, 2006

Trading a red hot market

Wah wah wah! Keppel Land and Capital Land rocks man. This is insync with my anticipation of the IR bidding opportunity. I posted my anticipation to my yahoo group hence you cannot find it in the posts of last weekend. However it must be noted, i was dead wrong about banks in January and cut my loss on DBS. I think y0u should be able to read it in the yahoo grp under messages. I can only salivate as both Lands are too expensive....so what to do? Play Cheena shares lor! haha The two stocks I bought base on Blueline theory still in profits. Infact all 4 contras last week are in profit! keke Yeah i admit i diverted from my own rules of no contra. But the way i see my blueline works magic in the market, i just cannot stand aside and do nothing. Hence here's what i did. I bought once they break the line of least resistance. My plan is simple, sit on it and ride the profits, if next day comes hesistation of not moving up or i detect the slightest selling, i will just cut my position. My risk is probably 2 to 3 cents but my profits is unlimited! Why? Just look at the rest of my quickpicks....they smelly smelly have profit margins of more than 3 cents easily. Don't take my words as it is, go study the past quickpick list and you will understand why i dare to contra. Please do not try this at home. keke I have the discipline to take losses, if you do not have. Do not contra!!!

GrowMoney Quickpick

Stock: Line of Least Resistance

Tat Hong: 0.890

ChinaSky: 1.06

AusGrp: 0.325

Starhub: 2.23

SembKim: 0.535

Zhongguo Powerplus: 0.340

Media Ring: 0.345

Labroy: 1.52

Tech oil & gas: 0.740

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

GrowMoney Quickpick

Stock: Line of Least Resistance

Tat Hong: 0.890

ChinaSky: 1.06

AusGrp: 0.325

Starhub: 2.23

SembKim: 0.535

Zhongguo Powerplus: 0.340

Media Ring: 0.345

Labroy: 1.52

Tech oil & gas: 0.740

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, March 27, 2006

Decipher to teach Stock Market Trading ?

By now, i'm sure alot of people are curious about what is blueline theory and line of resistance? Why decipher's growmoney quickpick has an uncanny accuracy? Let me describe blueline theory one more time. : ) Stocks that break their line of least resistance (I termed it blueline) will continue it's movement upwards the chart. However, not every stocks that break the resistance will be successful, some will falters and come back down. Hence there are a full range of rules of how to identify blueline stocks and track them. How to manage emotions trading them and a good system to make this system profitable. Currently, I'm gathering all these rules and testing them. The most important work i'm doing is back testing this strategy from 2002. I don't want to be in the dark if this strategy only works in 2006!!! Suicidal! I die alone nevermind, i cannot let 700 of you die with me! So right now, just take my quickpick list and do your own analysis.

Also, i'm preparing for a "Meet the people session" in April. This session is really to meet and say hello to you, just like our MPs hor. keke Be sure to join my yahoo group to be invited. Limited seats hor. : ) I will also hold a ballroom size kind of training session to teach all i know. Don't worry, it will not be charged in the thousands! It will be reasonably, affordably priced. When I started trading, it is exactly the expensive courses and trading software that irks me. How to attend a course if it will cripple my trading account? I rather you keep the money and use it to trade. If I can start a blog for free sharing, you can trust me to deliver best value at a price that won't eat up your trading account! So join my yahoo group so that you will receive the invitation when my materials are prepared!

Watch your profits! Tuesday night Fed Chief giving talks on economy...i don't know what he will say, but watch out! :D

GrowMoney QuickPick

Stock: Line of Least Resistance

Media Ring: 0.345

People's food: 1.24

SembKim: 0.535

Zhongguo Powerplus: 0.340

Starhub: 2.23

PacAndes: 0.780

Tat Hong: 0.890

ChinaSky: 1.06

AusGrp: 0.325

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Also, i'm preparing for a "Meet the people session" in April. This session is really to meet and say hello to you, just like our MPs hor. keke Be sure to join my yahoo group to be invited. Limited seats hor. : ) I will also hold a ballroom size kind of training session to teach all i know. Don't worry, it will not be charged in the thousands! It will be reasonably, affordably priced. When I started trading, it is exactly the expensive courses and trading software that irks me. How to attend a course if it will cripple my trading account? I rather you keep the money and use it to trade. If I can start a blog for free sharing, you can trust me to deliver best value at a price that won't eat up your trading account! So join my yahoo group so that you will receive the invitation when my materials are prepared!

Watch your profits! Tuesday night Fed Chief giving talks on economy...i don't know what he will say, but watch out! :D

GrowMoney QuickPick

Stock: Line of Least Resistance

Media Ring: 0.345

People's food: 1.24

SembKim: 0.535

Zhongguo Powerplus: 0.340

Starhub: 2.23

PacAndes: 0.780

Tat Hong: 0.890

ChinaSky: 1.06

AusGrp: 0.325

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, March 26, 2006

Blueline Theory works it's charm on Stock Market

What a closing on Friday! Although index has nothing to show for, but individual stocks went crazy. Particularly Cheena stocks. They went crazy after half time! Just as i hated myself for missing out on Thursday, I grabbed every opportunity on Friday morning to buy when many of my quickpicks breaks key resistances. By the end of the day, I am sitting on profits already. keke It's not a guarantee that i will make a killing this time round. But in trading, if I cut loss at 2 cents loss and take profits at 10 cents, it is a sensible plan. Just like a soccer match, if you keep playing the ball in mid field and doesn't attempt a shot, how on earth are you going to win the match? Of course it takes guts to place a trade. Where will the guts come from? My guts come from staring at past charts over the last 2 years, doing back testing of strategies and knowing what works what doesn't. The comfortness in placing the trade comes from confidence which in turn comes from experience. Know what you are doing and go for it! Let's tua tua huat tomorrow!!!

GrowMoney QuickPick

Stock: Line Of Least Resistance

Labroy: 1.52

SembKim: 0.535

Tech oil & gas: 0.740

Tat Hong: 0.890

City Dev: 10.40

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

GrowMoney QuickPick

Stock: Line Of Least Resistance

Labroy: 1.52

SembKim: 0.535

Tech oil & gas: 0.740

Tat Hong: 0.890

City Dev: 10.40

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Thursday, March 23, 2006

Stock Market bull trap?

The market finish today with as much of rebound as yesterday's declines. One very important missing factor was the volume! Volume is lighter today than yesterday for most counters. I was correct in anticipating a weak session after many of the breakouts U-turned which i mentioned in the last post. I rate today's rebound as weak.

Blueline theory is working it's charm! It was really a wonderful feeling as i checked and compare the results of my scans yesterday and the closing prices... you wouldn't believe it. YHI, ManWah, Thomson medical, Allgreen...they are in my homework! I didn't post them online because i was paper testing it. Now that it's more or less confirmed....*drum roll* Ladies and Gentlemen, may i present to you, the likely stars of tomorrow!

Blogspot fails again when it comes to uploading of charts. Anyway, there is no need to see charts, i seen and filtered what i like and dislikes. Convenience at your fingertips. : ) Reward me pls!!!

Growmoney QuickPick

Stock : Line of least resistance

Asia Env : 0.325

Hong Guo: 0.475

C&O : 0.480

ChinaWheel: 0.395

ChinaPetro: 0.710

China Diary: 0.470

Semb Kim: 0.535

Wingtai: 1.70

MFS: 1.18

Keppel Land: 4.50

Ezra: 2.64

HPL: 1.84

Remember, it must break convincingly, otherwise just cut loss. For a true breakout, it will follow through the next day. If it dilly dally, just cut.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Blueline theory is working it's charm! It was really a wonderful feeling as i checked and compare the results of my scans yesterday and the closing prices... you wouldn't believe it. YHI, ManWah, Thomson medical, Allgreen...they are in my homework! I didn't post them online because i was paper testing it. Now that it's more or less confirmed....*drum roll* Ladies and Gentlemen, may i present to you, the likely stars of tomorrow!

Blogspot fails again when it comes to uploading of charts. Anyway, there is no need to see charts, i seen and filtered what i like and dislikes. Convenience at your fingertips. : ) Reward me pls!!!

Growmoney QuickPick

Stock : Line of least resistance

Asia Env : 0.325

Hong Guo: 0.475

C&O : 0.480

ChinaWheel: 0.395

ChinaPetro: 0.710

China Diary: 0.470

Semb Kim: 0.535

Wingtai: 1.70

MFS: 1.18

Keppel Land: 4.50

Ezra: 2.64

HPL: 1.84

Remember, it must break convincingly, otherwise just cut loss. For a true breakout, it will follow through the next day. If it dilly dally, just cut.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Tuesday, March 21, 2006

Cheena Shares Dominates in Stock Market

As anticipated Cheena shares dominates again. My market scan shows that the underlying strength of the market is strong. There were so many breakouts in my list. Hence I had the luxury to select those with better risk/reward ratio. STI is now trading at 2510, the nearest resistance is 2520. Look out. If market hit into this resistance and unable to break, i will exercise caution as prices might retrace yet again. Surely you don't want to be caught in the offside trap. There were many breakouts, but if these breakouts make a U-turn today, then it is not a good sign. Let's watch on.

GrowMoney Quick Pick

CG-Tech

SunRay

China Diary

China Sun

Shang Turbo

*I have problems uploading yet again hence had send the charts to my yahoo group instead.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

GrowMoney Quick Pick

CG-Tech

SunRay

China Diary

China Sun

Shang Turbo

*I have problems uploading yet again hence had send the charts to my yahoo group instead.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, March 20, 2006

Stock Market continues to favour pennies trading

Cheena stocks remained in the limelight with Casino plays firming up for a run. I can't remember the exact date but the tender for the 2 IRs ends sometime this month. Bank sector remained weak. DBS breaking $16.00 support finally dragging the STI index below 2500. Also remember to look out for Federal, Tiong Woon and Rotary. They are sister stocks who often time than not, run together.

We have strong sessions in Japan and US last week. This should set a positive tone in the morning. But, it is really the afternoon that counts. Right from the top of 2520, we have had a soft landing of the index to 2496. Index should find some support near term, form a base and continues the onslaught!

Rotary: It attracted lots of attention last week when it started turning. As anticipated, the 0.495 should more or less be a base for now. Check back the earlier charts for rotary to see if the build up make sense.

KeppelLand: Casino Play

Contel: It is very important to study charts of stocks that I have missed. Just like preparing for exams, you have to revise your homework. I didn't realise the importance when i was early in my trading business. Now, the more charts i look at, the more experience and knowledge i will have.

Capital Land: Casino Play.

MediaRing: Asysmetrical Triangle

Federal: Bollinger Squeeze.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

We have strong sessions in Japan and US last week. This should set a positive tone in the morning. But, it is really the afternoon that counts. Right from the top of 2520, we have had a soft landing of the index to 2496. Index should find some support near term, form a base and continues the onslaught!

Rotary: It attracted lots of attention last week when it started turning. As anticipated, the 0.495 should more or less be a base for now. Check back the earlier charts for rotary to see if the build up make sense.

KeppelLand: Casino Play

Contel: It is very important to study charts of stocks that I have missed. Just like preparing for exams, you have to revise your homework. I didn't realise the importance when i was early in my trading business. Now, the more charts i look at, the more experience and knowledge i will have.

Capital Land: Casino Play.

MediaRing: Asysmetrical Triangle

Federal: Bollinger Squeeze.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Wednesday, March 15, 2006

Swing Trading in Stock Market

Market is trading at high volatility and I have decided to do swing trading. I don't believe we can see the bullish days of Jan anytime soon. Until then, swing trading should be more rewarding. I hate to see profits get eaten away.

GrowMoney QuickPick

AsiaPharm

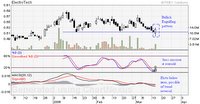

Electrotech

MMI

MFS: Another blueline theory that works

Global Voice: Reversal?

C&O

ChinaPetro: Another Blueline That works!

MemoryD: How you can apply Blueline theory here.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

GrowMoney QuickPick

AsiaPharm

Electrotech

MMI

MFS: Another blueline theory that works

Global Voice: Reversal?

C&O

ChinaPetro: Another Blueline That works!

MemoryD: How you can apply Blueline theory here.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, March 13, 2006

Trading a bullish stock market

As anticipated, the bullish sentiment spilled over from US market and Japan market. Although the market rallies, I am not part of it!!! haha Yes, those who knew, my stocks remained under consolidation. Consolidation? or is it reversal? A little debate has started this morning in the shoutbox. Defend as i might but i cannot deny that i should have cut at my cut loss level. The reason i held on was because the volume of the decline is very light. Many suggest that this can lead to a slow death. My initial plan was to ride out this consolidation zone and stop trading. How wrong can i be! If I do that, i will be repeating my loser mentality of 2004-2005 where i stubbornly held HG-Metal despite kind advices from trading veterans. I snapped out of it and started trading once again. I continue to see my quickpick provides very good trading opportunities at times. As a trader, i cannot stop trading. Otherwise my trading system will fail. Trading system should be followed consistently because while it cannot guarantees you to win everytime, it does increase your odds over time. Every loss will be made up by wins. If you sit on losses and refuse to trade, you can't win. You can't win, no profits.

Chips sector came out in my sentiment analysis. Time to load up? Read on!

GrowMoney QuickPick

UTAC: Look out for a chance to re-enter.

Tech,Oil & Gas: This was in my quickpick list last week. Decipher's blueline theory works it's magic again.

SGX: Caught everyone by surprise.

MFS: Decipher's Blueline Theory

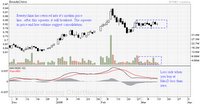

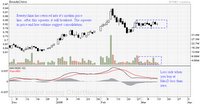

China Diary: Bearish Reversal pattern.

Chartered: 1.49 key resistance

Beyonics: HDD sector looks good. Bullish reversal pattern spotted confirmed with indicators. Watch on.

Beauty China : Although technically looks fine...the overall market sentiment on china stocks should be considered.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Chips sector came out in my sentiment analysis. Time to load up? Read on!

GrowMoney QuickPick

UTAC: Look out for a chance to re-enter.

Tech,Oil & Gas: This was in my quickpick list last week. Decipher's blueline theory works it's magic again.

SGX: Caught everyone by surprise.

MFS: Decipher's Blueline Theory

China Diary: Bearish Reversal pattern.

Chartered: 1.49 key resistance

Beyonics: HDD sector looks good. Bullish reversal pattern spotted confirmed with indicators. Watch on.

Beauty China : Although technically looks fine...the overall market sentiment on china stocks should be considered.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, March 12, 2006

Time For Trading the Singapore Stock Market

China stocks continued to be the favourites at the moment. However on late Friday afternoon, we saw profit taking accross the board. I checked my sentiment anlaysis of the Singapore Stock Market, it was rather mixed than bearish. US stock market rallies overnight. It looks almost certain that we will have a spill over effect tomorrow morning. The recent declines in many stocks are of light volume. Infact my own holdings were squeezed. I am not cutting loss as yet because this to me is a shakeout. The real threat comes from heavy volume selling. This is what i learnt over the years. Let's see would i be pleasantly surprise by end of the week.

I have also graphicised my quickpicks! Hence you have the charts at your fingertips! Another great initiative brought to you by Decipher. Also, I'm thinking of REIT 'ing my blog. Since I am receiving revenue from Google, i wonder if you guys are interested in being my shareholders and I pay dividends every month? keke Doesn't that sound fun? :D

GrowMoney QuickPicks

China Petro: A small Cup and a small handle

Capcomm: The ultra light volume has caught my eyes.

MFS: Watch out for the line of least resistance.

MediaRing: Possible of a shakeout of weakholders last week.

Rotary: Progressive Charting

Sunray: Fundamentally sound company. Recent weakness is a cause of caution with price still yet to show bottomed actions. Volume has been light though.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

I have also graphicised my quickpicks! Hence you have the charts at your fingertips! Another great initiative brought to you by Decipher. Also, I'm thinking of REIT 'ing my blog. Since I am receiving revenue from Google, i wonder if you guys are interested in being my shareholders and I pay dividends every month? keke Doesn't that sound fun? :D

GrowMoney QuickPicks

China Petro: A small Cup and a small handle

Capcomm: The ultra light volume has caught my eyes.

MFS: Watch out for the line of least resistance.

MediaRing: Possible of a shakeout of weakholders last week.

Rotary: Progressive Charting

Sunray: Fundamentally sound company. Recent weakness is a cause of caution with price still yet to show bottomed actions. Volume has been light though.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Thursday, March 09, 2006

Position updates for Singapore Stock Market

Singapore Stock Market had a late rally to close up above 2500 levels. However I noted that the broadbase market is led by losers than gainers. I would still exercise caution from here. Today I gave an update on my 3 positions. All 3 retraced with light volume but i am being squeezed. I still will not cut my position until i see heavy volume selling. Chng Kays sell on the way to the top or distribute at the top. They do not sell on the way down. This was what i learnt and I shall stick to it. Often times, i find myself keep changing strategies and that can prove costly if you see the stocks rebound and take out new high when you cut loss. The 3 counters I am holding are of sound FA. Let's watch on.

Rotary - short term weakness. But I have an anticipatio in April.

Sunray - Retraced from 52 weeks high on weak volume. Should be a healthy retrace before rockets up.

Media Ring - A turn around company. It's bidding war with Vantage on going. Currently the top VOIP play.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Rotary - short term weakness. But I have an anticipatio in April.

Sunray - Retraced from 52 weeks high on weak volume. Should be a healthy retrace before rockets up.

Media Ring - A turn around company. It's bidding war with Vantage on going. Currently the top VOIP play.

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Monday, March 06, 2006

A lesson on Trading Warrants in the stock market

Yes!!! We have done it! Stock Market closes in new high! 2520 is the next resistance...an old high from early 2000 during the IT bubble days. With many analysts calling for a correction, it pays to be nimble from now. Infact as I had stated out in the beginning of Febuary, I was looking forward to trim my positions and exposure to risk as we climb higher. Now I'm left with 3 stocks. I am going to be nimble from here.

I remember starting out the year 2006, i wrote a memo to my yahoo group and in that memo, i reminded everyone that warrants are a trading instruments. They should not be used to invest and sit on it. The reason is, in warrants, we have time decay. Every passing day, means that the warrant will be closer to expiry date and the warrant price will depreciate by itself! An example is buying DBS warrant say at 0.20 when the DBS share price is $16.40. After many weeks of sideway trading without the mother share going anywhere, the next time you look at the mother share, it is again at $16.40. But guess what? The warrant price now could be just 0.180 because of the sideway trading eating away precious time! This is time decay for you!

I got into 3 warrants in January. Mistakes i made was, anticipating a rally in the mother share that never came and time decay eats into my warrants. I had to cut the 2 warrants before it decays further as the mother share isn't going anywhere. The 3rd was cut today, about 2 months after I bought it. It's Datacraft warrant. I had 2 chances of taking my profit but i did not because the mother share looks like it was going up! In the end time decay eats away my paper profits as the mother share went side way trading.

So a friendly advice, although warrant is a faster way to accumulate wealth, it is also the fastest way to losing your wealth if you are not careful. Trade with care!

GrowMoney Quickpick!

Decipher's blueline theory - Every 52 weeks high broken with heavy volume will bring us to higher ground. The line of least resistance is almost non existent because there are no overhanging shareholders. It's an easier path to the north.

Stock : Line of least resistance

Celestial : 1.08

China Petro : 0.58

FibreChem : 0.95

SkyPetrol : 0.57

SunRay : 0.515

SembKim : 0.535

ChinaSun : 0.72

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

I remember starting out the year 2006, i wrote a memo to my yahoo group and in that memo, i reminded everyone that warrants are a trading instruments. They should not be used to invest and sit on it. The reason is, in warrants, we have time decay. Every passing day, means that the warrant will be closer to expiry date and the warrant price will depreciate by itself! An example is buying DBS warrant say at 0.20 when the DBS share price is $16.40. After many weeks of sideway trading without the mother share going anywhere, the next time you look at the mother share, it is again at $16.40. But guess what? The warrant price now could be just 0.180 because of the sideway trading eating away precious time! This is time decay for you!

I got into 3 warrants in January. Mistakes i made was, anticipating a rally in the mother share that never came and time decay eats into my warrants. I had to cut the 2 warrants before it decays further as the mother share isn't going anywhere. The 3rd was cut today, about 2 months after I bought it. It's Datacraft warrant. I had 2 chances of taking my profit but i did not because the mother share looks like it was going up! In the end time decay eats away my paper profits as the mother share went side way trading.

So a friendly advice, although warrant is a faster way to accumulate wealth, it is also the fastest way to losing your wealth if you are not careful. Trade with care!

GrowMoney Quickpick!

Decipher's blueline theory - Every 52 weeks high broken with heavy volume will bring us to higher ground. The line of least resistance is almost non existent because there are no overhanging shareholders. It's an easier path to the north.

Stock : Line of least resistance

Celestial : 1.08

China Petro : 0.58

FibreChem : 0.95

SkyPetrol : 0.57

SunRay : 0.515

SembKim : 0.535

ChinaSun : 0.72

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Sunday, March 05, 2006

Stock Market on the brink of breaking new highs!

I came back from the weekend with very very enriching stuffs inside my head! It has never struck me why am I the most visited trading blog around town, look to your right, 100,000 visitors soon! How did i manage to stumble into the idea of starting a trading journal online? Why are there many others trying to do what i have done? I found my answers after attending what could be the important seminar of my life! I am a natural creator and a star! By definition, I have the natural talent that people will notice in me when I'm showing it, unique personality and the ability to create an identity!

Without knowing, I have intuitively created a brand, growmoney and an identity known as Decipher right here! The best part of all this, I am having so much fun doing all these! Most importantly, I have brought with me value. It is this value that you keep returning to my website everyday and I thank you for that. My value is my sincerity in sharing my analysis, my losses and my wins! From giving, i end up receiving from Google which all you good people there who were supporting my blog on a daily basis *take a bow*, Thank you!

I always wanted my visitors to avoid my mistakes, learn them together so you will not lose money! I have lost money from March'04 right through to July'05! I could have just thrown in the towel and decided that I am not good at trading. But I did not! Guess what happened 6 months after July'05? I have started to profit consistently! This is what matters! The past does not equals the future! Just read my archives and you will see how did i fare so far. By the way, everyone losses money in the market, it is how you should not repeat the same mistakes that counts! From now on, I will seek my true path and growmoney the fun way! : ) Ok enough about me, Let's head on to the market!!! haha

If you have known me from the Wealth Dynamics Weekend and visiting for the first time, Hello and Welcome! : )

China stocks seems to be still very much in play but I will be very nimble on them. I never forgets the gravity rule which applies to the market as well. Last Friday's closing was bullish! We are threatening to break the STI 2500 level!!! The day started with selling and i thought the market stood firm from the selling pressure. What came next in the afternoon was waves of buying. Everyone was cheering in the shoutbox above! haha With Elections boundaries in the news, GE can be very near us. When GE is around the corner, the stock market will celebrate. Watch out for this profitable opportunity!

You must read this!!!

Sunray: I witnessed what I thought was a classic accumulation manipulation. This is what happened, I sold on Thursday after i saw that the counter finishes the day with a higher shadow. The buyer from my sale was Meril Lynch! I did not think much about it because they could be buying for someone of high networth. My handphone went off 2 times, first in the morning when Sunray hit 0.515, the volume wasn't great and hence i did not pay much attention to it. Then the second time came, that's around 4pm. The price again hit 0.515, i like what i saw, selling during the day and buying near closing. A quick glance at the tape showed that more people are buying up and accumulation seems to be taking place. I grabbed 50% of what I wanted to own and the seller was UOBKayhian! This must be a retailer selling. With UOBKayhian selling, Meril Lynch buying, i would rather follow the buying! Of course all this observation will be a joke, if we see Sunray not breaking higher levels in the coming days! :D

GrowMoney Quickpick!

Decipher's blueline theory - dudes! You got to scroll down and check last week's quickpick list!! I have at least 4 good trades!

Stock : Line of least resistance

Celestial : 1.08

China Petro : 0.58

FibreChem : 0.95

SkyPetrol : 0.57

SunRay : 0.515

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Without knowing, I have intuitively created a brand, growmoney and an identity known as Decipher right here! The best part of all this, I am having so much fun doing all these! Most importantly, I have brought with me value. It is this value that you keep returning to my website everyday and I thank you for that. My value is my sincerity in sharing my analysis, my losses and my wins! From giving, i end up receiving from Google which all you good people there who were supporting my blog on a daily basis *take a bow*, Thank you!

I always wanted my visitors to avoid my mistakes, learn them together so you will not lose money! I have lost money from March'04 right through to July'05! I could have just thrown in the towel and decided that I am not good at trading. But I did not! Guess what happened 6 months after July'05? I have started to profit consistently! This is what matters! The past does not equals the future! Just read my archives and you will see how did i fare so far. By the way, everyone losses money in the market, it is how you should not repeat the same mistakes that counts! From now on, I will seek my true path and growmoney the fun way! : ) Ok enough about me, Let's head on to the market!!! haha

If you have known me from the Wealth Dynamics Weekend and visiting for the first time, Hello and Welcome! : )

China stocks seems to be still very much in play but I will be very nimble on them. I never forgets the gravity rule which applies to the market as well. Last Friday's closing was bullish! We are threatening to break the STI 2500 level!!! The day started with selling and i thought the market stood firm from the selling pressure. What came next in the afternoon was waves of buying. Everyone was cheering in the shoutbox above! haha With Elections boundaries in the news, GE can be very near us. When GE is around the corner, the stock market will celebrate. Watch out for this profitable opportunity!

You must read this!!!

Sunray: I witnessed what I thought was a classic accumulation manipulation. This is what happened, I sold on Thursday after i saw that the counter finishes the day with a higher shadow. The buyer from my sale was Meril Lynch! I did not think much about it because they could be buying for someone of high networth. My handphone went off 2 times, first in the morning when Sunray hit 0.515, the volume wasn't great and hence i did not pay much attention to it. Then the second time came, that's around 4pm. The price again hit 0.515, i like what i saw, selling during the day and buying near closing. A quick glance at the tape showed that more people are buying up and accumulation seems to be taking place. I grabbed 50% of what I wanted to own and the seller was UOBKayhian! This must be a retailer selling. With UOBKayhian selling, Meril Lynch buying, i would rather follow the buying! Of course all this observation will be a joke, if we see Sunray not breaking higher levels in the coming days! :D

GrowMoney Quickpick!

Decipher's blueline theory - dudes! You got to scroll down and check last week's quickpick list!! I have at least 4 good trades!

Stock : Line of least resistance

Celestial : 1.08

China Petro : 0.58

FibreChem : 0.95

SkyPetrol : 0.57

SunRay : 0.515

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Friday, March 03, 2006

Applying Technical Analysis on Stock Market

Wednesday, March 01, 2006

Singapore Stock Market bucked the trend!

With an overnight loss in US market, market opened threatening a carbon copy performance but not only did we hold our ground, the afternoon rally gave everyone a sweet surprise!

Exciting time is here! We are just a few steps away from STI's historiecal high of 2582!!! Once past this point...the sky's the limit. Also, please open and get ready your futures account. I will be getting ready to short the index all the way down. The great reversal will happen when a reversal pattern is formed on the weekly chart. I am going to get ready for that day. If you have regretted not buying at the bottom in 2003, now is the chance for you to short the bluechips! It is as profitable as buying in 2003. You will need a CFD or SBL account though. The reversal is not here yet hor....i'm just getting ready. :)

DataCraft: Very nice Channel Trading zone which offers good risk/reward opportunity.

Sunray: The rally today caught everyone by surprise. It was a share placement and market like the future outlook of the company. Look out for the line of least resistance.

MediaRing: The buying today totally reversed the sell off reaction to the news.

GrowMoney QuickPick

Decipher's blueline theory - so far Semb Corp and Ascott has been reacting well to this system.

Stock : Line of least resistance

Pac Andes : 0.735

Pine Agritech : 1.45

Tech Oil&Gas : 0.535

Capitaland : 4.20

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Exciting time is here! We are just a few steps away from STI's historiecal high of 2582!!! Once past this point...the sky's the limit. Also, please open and get ready your futures account. I will be getting ready to short the index all the way down. The great reversal will happen when a reversal pattern is formed on the weekly chart. I am going to get ready for that day. If you have regretted not buying at the bottom in 2003, now is the chance for you to short the bluechips! It is as profitable as buying in 2003. You will need a CFD or SBL account though. The reversal is not here yet hor....i'm just getting ready. :)

DataCraft: Very nice Channel Trading zone which offers good risk/reward opportunity.

Sunray: The rally today caught everyone by surprise. It was a share placement and market like the future outlook of the company. Look out for the line of least resistance.

MediaRing: The buying today totally reversed the sell off reaction to the news.

GrowMoney QuickPick

Decipher's blueline theory - so far Semb Corp and Ascott has been reacting well to this system.

Stock : Line of least resistance

Pac Andes : 0.735

Pine Agritech : 1.45

Tech Oil&Gas : 0.535

Capitaland : 4.20

DISCLAIMER: This is not an inducement to buy or sell. You should do your own analysis on top of my postings. Copyright © 2006 GrowMoney Blog. All rights reserved.

Subscribe to:

Posts (Atom)